Financial Market Insight

Highlights

Key Takeaways

- Last Month's Takeaway: AI Enthusiasm Could Soon Be the Only Thing Holding Up This Market

- Economic Cheat Sheet: Fed Surveys in Focus

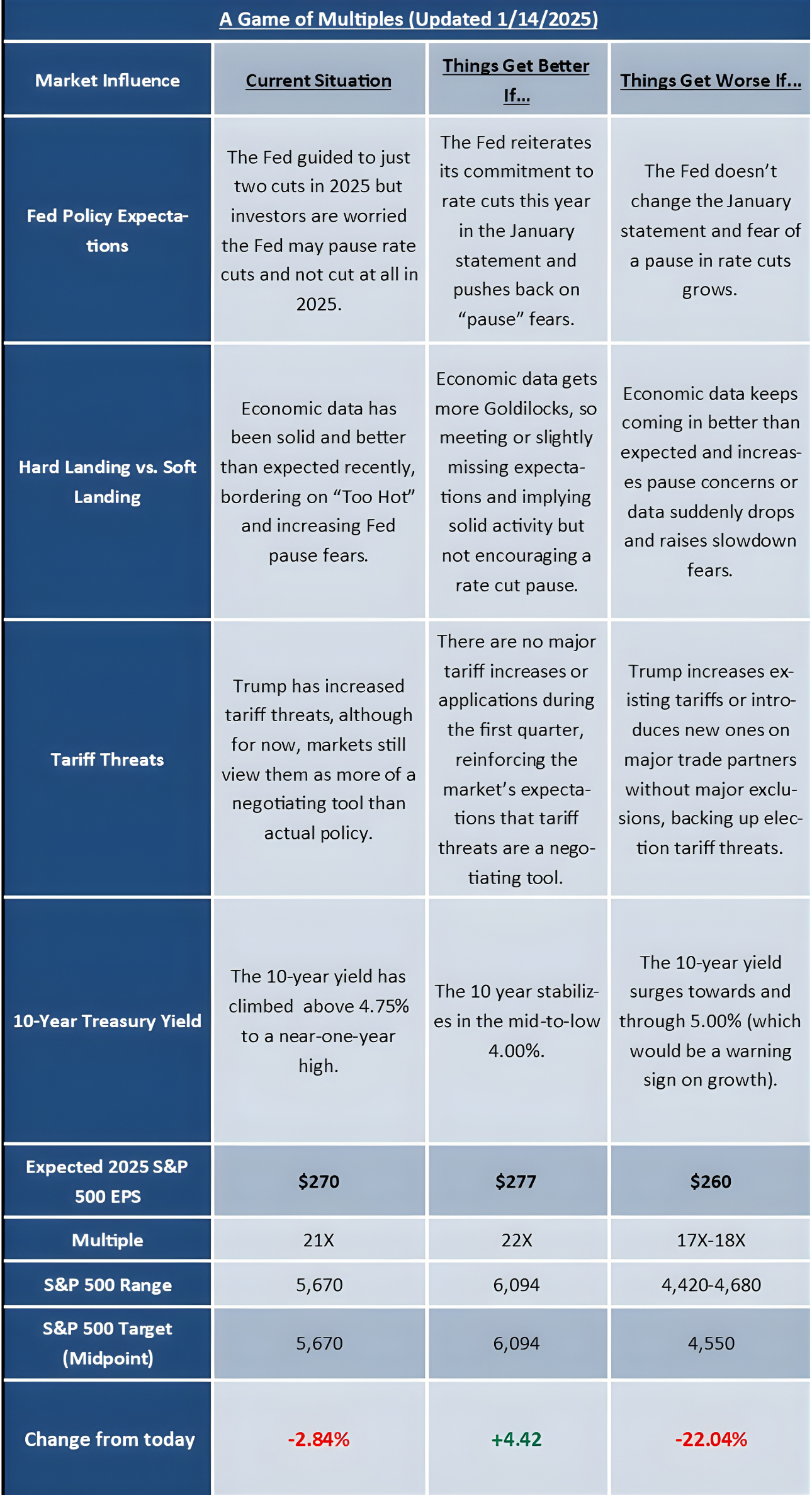

- October Market Multiple Table

Stocks

S&P 500

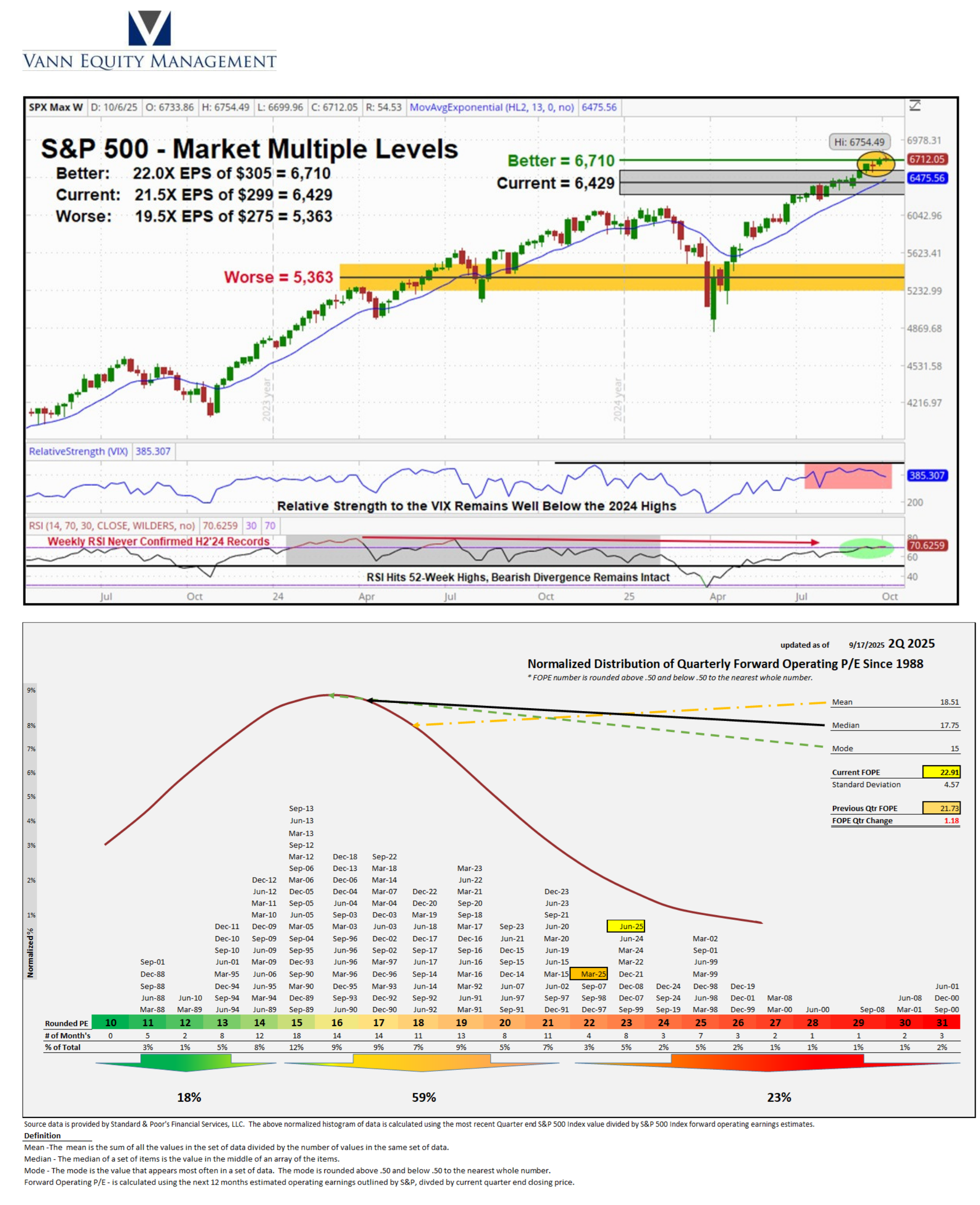

Technical View: The trend in the S&P 500 has shifted back to cautiously bullish as the index continues to grind to new record highs.

Dow Theory: Bearish since the week-ended March 14, 2025

Key Resistance Levels: 6765, 6700, 6620

Key Support Levels: 6502, 6416, 6287

SOURCE: Factset and Vann Equity Management Research Team

Stocks dropped last week thanks mostly to the escalation of U.S./China trade tension, although investors don't expect it to result in another full-on trade war between the two countries.

✓ What is Outperforming: AI-related tech, cyclical sectors, small caps.

✓ What is Underperforming: Defensive sectors, energy.

Last Month's Takeaway: AI Enthusiasm Could Soon Be the Only Thing Holding Up This Market

Overview

Last month, it felt like driving a steady highway and suddenly hitting a patch of gravel. Headlines about U.S. and China trade tensions reminded everyone that policy can still jolt prices, even when the economy itself changes more slowly. At the same time, leadership in the stock market remains very concentrated. A relatively small group of companies tied to artificial intelligence continues to do most of the heavy lifting for the indexes. That concentration can work, until it does not.

Three takeaways

- Trade remains a swing factor. Think of trade policy like the weather over the ocean. Ships can sail in a straight line for weeks, and then a single front changes the sea state. Markets ignored trade for months because the daily data did not show immediate damage. But tariff uncertainty still hangs over pricing and corporate planning. Companies react by delaying purchases, shifting supply chains, or holding more inventory than they would otherwise. None of that is fatal to growth, but it dulls the edge. The key point is simple: policy headlines may fade, but they never fully disappear, and they can still tilt sentiment quickly.

- Growth is moderating, not collapsing. The labor market is cooling from very strong levels. Fewer job openings, slower hiring, and more selective wage growth tell the same story. Add in the temporary drag from government disruptions, and you have a recovery that is jogging instead of sprinting. In that context, additional rate cuts are a mixed blessing. They help with financing conditions, but if investors view them as the Federal Reserve reacting to softer data, the psychological boost to stocks can be smaller. This is not a crisis call. It is a reminder that the backdrop is fine but not spectacular, which argues for realistic return expectations.

- AI investment is the current engine. AI is the new build-out cycle. Data centers, chips, networking, power, and software tools are absorbing very large capital budgets. That spending supports a narrow set of beneficiaries and, through them, the broader indexes. Recently, market enthusiasm has clustered around a few marquee partnerships and expansion plans. The effect is powerful: when investors believe the AI build-out will keep accelerating, multiples expand and pull indexes higher. The risk is equally clear. If evidence emerges that deployments are slower than expected, or that returns on AI spending arrive later than hoped, the air can come out quickly. A single pillar can hold weight, but it is still a single pillar.

What does this mean?

New heights can create the impression of broad health. Under the surface, leadership is narrow and sensitive to one theme. That does not make the rally fragile on its own, but it does reduce the market's margin for disappointment. If AI remains strong, indexes can grind higher even with uneven macro data. If AI cools, the market has to re-price for slower growth and higher policy noise. That adjustment tends to be fast rather than gentle.

How are we positioned?

- Diversification first. We spread risk across sectors, styles (Large Cap Growth vs Large Cap Value), and geographies (US vs International) so that one theme does not dictate outcomes.

- Do not chase, do not fight. We respect current leadership without letting it dominate portfolios.

- Rebalance with intent. We trim strength and add to quality laggards on weakness, guided by each model's risk tolerance and percentage weighting to the Vann Equity Management Asset Allocation Model.

- Quality bias. We favor strong balance sheets, durable cash flows, and pricing power. Those traits carry portfolios through slower growth periods.

- Liquidity ready. We maintain dry powder in balanced accounts so we can act on opportunities rather than react to volatility.

Bottom line:

This market can keep moving forward on AI strength, but everyone should understand the setup. Gains are riding on a narrow engine while growth cools and policy noise lingers. Our job is to capture participation without letting a single theme decide your outcome. That is why we stay diversified, keep a quality tilt, and rebalance with discipline. As long as the AI cap-ex enthusiasm lasts, stocks can hold on. But AI is becoming a larger and larger lynchpin holding up the markets, and if doubts emerge about the stimulative power of AI for the entire economy and market, then investors will have to face this less-than-ideal reality, and the decline could be sharp and painful. We are not saying that it is going to happen, but we do want our clients to be aware of that reality, so we understand this market strategy. Having said that, with valuations where they are looking at Trailing Twelve Month (TTM) P/E greater than 29x over the last 50 years, we do want to remind clients that throughout the last 50 years, we have traded at high multiples for an extended period of time.

Longest streaks (Months ≥29x P/E):

- 16 months: May 2001 → Aug 2002

- 12 months: Nov 2008 → Oct 2009

- 11 months: Nov 1998 → Sep 1999

- 11 months: Jun 2020 → Apr 2021

Current streak (as of Oct 2025): 4 months - Jul 2025 → Oct 2025 (29.06x, 29.58x, 30.38x, 30.97x).

Economic Data

Economic Data (What You Need to Know in Plain English)

Government data this month has been limited due to the government shutdown, but what we did get leaned dovish. The FOMC minutes signaled a committee that is more focused on a cooling labor market than on still-elevated inflation. That strengthened expectations for two additional cuts this year. Consumer sentiment from the University of Michigan beat expectations, and inflation expectations were contained, which supported the same view.

Three takeaways

- Fed bias is toward easing. Minutes point to rate cuts as the default path, with debate around "how many," not "whether."

- Markets want confirmation. For rate-cut expectations to push stocks higher, investors will likely need to see odds rise for a total of about 75 basis points of easing by year-end.

- Inflation expectations are calm. Near-term and five-year expectations were contained, which gives the Fed more room to prioritize growth risk.

What does the rest of the month hold?

- Delayed: CPI, PPI, and Retail Sales will not publish during the shutdown. These are usually the heavy hitters for markets.

- Arriving: Empire Manufacturing (Wed), Philly Fed (Thu), and the Fed Beige Book (Wed). These are normally second-tier, but with the big reports missing, they matter more than usual.

How to read the incoming data?

- Best case for markets: Stable activity readings and steady price components. That would keep the "soft landing plus two cuts" narrative intact.

- If activity softens: A weaker tone or more labor concerns in the Beige Book would lift cut expectations. That can be a short-term positive for stocks, but it also acknowledges slower growth.

- If price gauges re-heat: Any firming in regional price indexes would challenge the easing narrative and could raise rate volatility.

Positioning lens

We remain balanced and disciplined: diversify by sector and factor, keep a quality bias, and use volatility to rebalance rather than chase. The goal is to participate if easing expectations build, while protecting capital if growth data underwhelms.

Bottom line:

With headline data on pause, smaller reports will steer sentiment. The market still prefers a Goldilocks mix of stable growth and cooling prices. We will adjust exposure as the data comes in, with each client's risk budget and time horizon in mind.

Special Reports and Editorial

October Market Multiple Table

The Hot PPI Threatens Multiple Pillars of the Rally

Since our last Market Multiple Table, the S&P 500 has pushed to fresh highs. The common thread is simple. AI Enthusiasm became the dominant force. Rate cuts and stable growth provided a supportive backdrop, but the marginal buyer has been leaning on AI headlines and capital spending plans. That is powerful while it lasts, but it also concentrates risk.

What has changed since last month

- AI Enthusiasm moved to the top. A run of AI-related news and partnerships kept demand strong across a narrow set of leaders.

- Policy backdrop stayed friendly. The Fed is cutting, and most data remain stable enough that softer prints are seen as supportive of more easing.

- Stagflation anxiety moved down the list. Without a clear re-acceleration in prices, that risk matters less near term.

Why this matters

Leadership is narrow. The market is leaning on one theme to justify a richer multiple. That works as long as AI Enthusiasm remains intact. If it fades, the market loses its main justification for trading well above long-term averages.

What the MMT says about valuations

- The index is trading above roughly 22x 2026 earnings.

- That multiple is being pulled higher by very large weights in a few mega-cap tech names with high growth expectations.

- As long as AI Enthusiasm holds, investors can rationalize paying this premium.

- If the narrative cools, a slide back toward 20x is plausible. On today's levels, that would imply about 600-800 points of downside in the S&P 500. That is not a forecast. It is simple math on the multiple.

What could move markets from here?

Things get better if:

- AI Enthusiasm stays firm through earnings season.

- The Fed keeps the door open to as much as 75 bps of additional cuts by year's end.

- Growth and inflation data stay broadly stable.

Translation: Multiple can stretch, fundamentals stay supportive, and a run toward 7,000 on the S&P 500 becomes reasonable.

Things get worse if:

- AI-linked earnings or deployment timelines disappoint, prompting multiple contractions.

- The Fed signals fewer cuts than the market expects.

- Growth data roll over.

Translation: The props under this rally weaken together. Both earnings and the market multiple fall, and downside accelerates.

Risk lens for clients

- The rally is real, but so is concentration risk.

- A modest disappointment could produce a 5% pullback quickly.

- A re-rating toward 20x on softer AI or growth would be larger and faster.

How are we positioned?

- Participate, do not depend. We maintain exposure to AI beneficiaries without letting a single theme drive outcomes.

- Quality and cash flow first. Balance sheets, pricing power, and durable margins matter more as multiples rise.

- Rebalance with discipline. We trim strength, add to quality on weakness, and size risk to each client's plan.

- Keep dry powder. Liquidity lets us act if volatility creates opportunity, and we generate cash/dry powder through Structured Income Notes.

Bottom line:

This market can continue to grind higher if AI Enthusiasm stays intact and the macro stays steady. The multiple is doing more work than usual, so vigilance matters. We will participate in upside while protecting against a scenario where enthusiasm cools faster than fundamentals can catch up.

S&P 500 Market Multiple Levels & Normalized Distribution

Chart visualization showing market multiple analysis

Ready to Navigate These Markets Together?

Schedule your portfolio review to discuss how these market dynamics may impact your allocation strategy.

Schedule Your ReviewRead next: August 2025 Market Insight — what moved stocks, rates, and sentiment last month.