Financial Market Insight

Highlights

Key Takeaways

- Market Impact of the Assassination Attempt on Former President Trump

- Acknowledging There is a Downside to Current Market Events, Too

- Weekly Market Preview: Do Growth and Earnings Hold Up?

- Weekly Economic Cheat Sheet: An Important Check on the Consumer This Week

- Is the Rotation from Tech to the “Rest of the Market” Sustainable?

- Powell Testimony Takeaways

- Market Multiple Table: An Important Change

Stocks

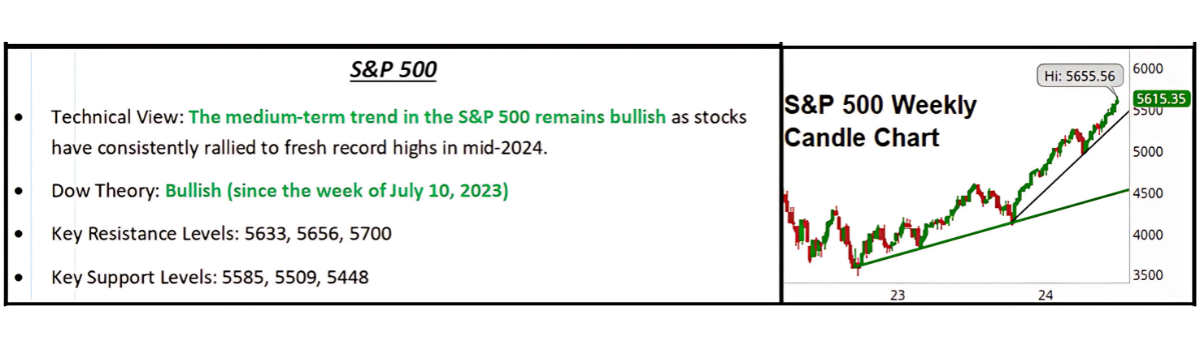

The S&P 500 hit yet another record high last week as CPI rose less than expected and boosted investor expectations for a September rate cut and two rate cuts in 2024.

✓ What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively outperformed recently as markets have become more volatile.

✓ What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

Market Impact of the Trump Assassination Attempt

Former President Trump survived an assassination attempt by an apparent lone gunman over the weekend. While obviously a troubling event regardless of political affiliation or preference, the market impact of it should be relatively limited because the market already assumes a Trump victory, and potential Republican sweep and the events of the weekend do not reduce those chances, and potentially increase them.

The S&P 500 hit yet another new high last week (the 36th of 2024!) as stocks continued to ride a wave of optimism surrounding three main events:

- Impending Fed rate cuts,

- Continued disinflation (decline in inflation), and

- Expectations for a Republican sweep in the November election.

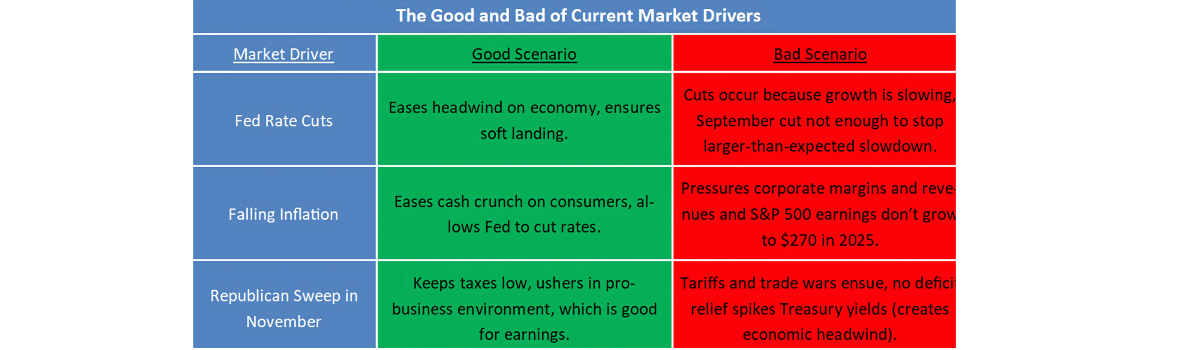

The “good” scenario of each of those events has been instrumental in sending the S&P 500 through 5,600. First, the Fed rate cuts will reduce pressure on the economy, likely reducing the chances of a hard landing. Second, disinflation will ease the “inflation tax” being paid by consumers, helping to make consumer spending (which is a critical part of the economy) more resilient. Finally, if Republicans sweep, the Trump tax cuts will be extended, and a more pro-business regime will take total power.

All of those outcomes are positive and expectations of them have rightly pushed stocks higher. However, there are negative outcomes from these events, and while we are not going to say they are likely, it would be a mistake for investors to simply assume there is no potential drawback to these events because there is a negative consequence for each of these that we must consider.

Reviewing these same points as above, fed rate cuts will reduce the headwind on the economy, but it is the “why” that matters. Is the Fed cutting rates because growth is slowing more than they anticipated? Slowing growth can be a major negative for markets and despite investor enthusiasm, rate cuts are not a guaranteed market positive event.

Second, disinflation does reduce headwinds on consumer spending; however, it can also reduce corporate earnings! The pandemic inflation has been a blessing to S&P 500 earnings, as consumers simply digested the price increases, boosting both revenue and margins across industries! However, inflation is now falling because 1) Supply chains have normalized and 2) Because the consumer is pulling back (less demand). Falling prices can compress margins and reduce revenue and we have seen evidence of that occurring across earnings recently (NKE and WBA a few weeks ago, DAL/CAG/PEP last week). Disinflation is a macroeconomic good, but it can also place downward pressure on earnings, which would be a negative for stock prices.

Finally, whether it is historically accurate, (the jury is out based on index performance) markets think Republican governments are positive for stock prices and ever since Biden’s poor debate showing, markets have been increasing expectations for a Trump win and a Republican sweep of the House and Senate. However, Trump is not a typical Republican. His stated tariff agenda risks a new trade war that will have unintended and unknown consequences (which could be bad). Additionally, debts and deficits will matter in the coming years. The Trump tax cuts may be extended if Republicans win, but if global bond markets do not see moves by the government to address the U.S. fiscal situation, Treasury yields could rise despite slowing growth, creating a vise for consumers and companies.

Economic Data (What You Need to Know in Plain English)

Fed rate cuts, falling inflation, and a Republican sweep are probably good for stock prices and the economy; however, they are not guaranteed good (and they could, in fact, be bad). Moreover, the market at these levels is ignoring the possibility these events are not positive. Our investment committee does not want to ignore these possibilities when we are thinking about current exposure, levels, etc. So, we are pointing them out here to make sure we keep ourselves grounded amidst this bubbling market euphoria.

Bottom line: Clearly the momentum in markets is higher and this is, currently, a Goldilocks environment for stocks. Yet the market continues to reek of complacency regarding some very substantial changes in macroeconomic forces compared to the past several years, and while our investment team sincerely hopes they all work out positively, we must acknowledge the downside of these events as well, because we will not get blindsided (as some advisors and investors will be) should one (or more) of these events not be as positive as currently expected.

CPI was the key report so far this month and it beat expectations, further signaling disinflation is ongoing and, most importantly, likely solidified the Fed will cut rates in September and kick off a rate cutting campaign.

The focus will turn to growth this week and while none of the data is from the major monthly reports, all growth data matters (especially given the Fed is about to start cutting rates) so that we can learn, as early as possible, if rate cuts will be enough to prevent a stall or contraction in the economy. Put simply, the chorus of economic data that has been pointing to a loss of momentum has grown louder over the past month and if that continues, growth concerns will creep higher.

The most important economic report this week is Wednesday’s June Retail Sales. The U.S. economy is a consumer-driven economy and put simply, if the consumer pulls back, the chances of a hard landing will rise. Retail spending has been, at best, plateauing lately and if that plateau turns into an outright decline or contraction, it will be an incremental negative for markets.

The next most important report will be the Empire Manufacturing Index and the Philly Fed Survey. These are the first data points of every month so they will give us the first look at July activity. Now, these metrics have been volatile, to put it generously, but they still matter in a broad sense of are they getting better, worse or about the same? Both have been largely about the same, showing a modest contraction in manufacturing in both regions in recent months and if that gets better, it is a mild positive. If it gets worse, it is a negative.

Bottom line: Growth has mattered all year and with the Fed rate cuts now known, it matters even more because it brings us closer to answering the question: “Did they cut in time?”—and the data will tell us.

Commodities, Currencies & Bonds

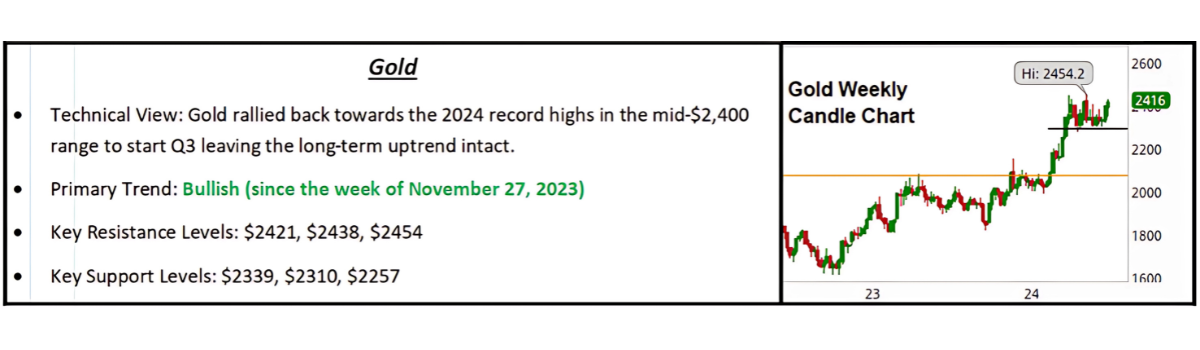

Commodities declined modestly last week despite a weaker U.S. Dollar, as global growth worries weighed on oil while gold saw a modest rally thanks to the lower dollar.

Gold was little changed through the front half of the week before lurching towards record highs on Thursday thanks to the cool June CPI data and the resulting combination of firming Fed rate cut expectations for the months ahead and rising confidence in the economy achieving a soft economic landing this year.

The Dollar Index declined again last week following the better-than-expected CPL report, as markets more fully priced in two rate cuts in 2024.

The better-than-expected CPI report was the main catalyst for markets last week and the result was as you would expect: A weaker dollar and lower Treasury yields.

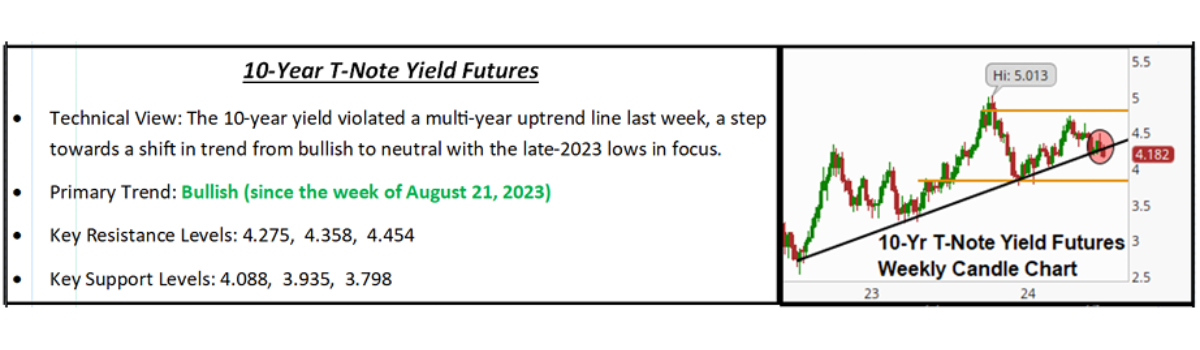

For now, falling rates remain positive for stocks but as we and others keep saying, falling yields will only stay positive for stocks until a certain point (Our team pegs that around 3.75%, but it could be a bit higher or lower). However, if the 10-year yield falls towards and through 4.00%, that will be a clear signal from investors they are getting more worried about growth—and at that point, falling yields will transition to a negative signal. So, the more the 10-year Treasury yield is stable between 4.00%-4.25%, the better for stocks.

Treasury yields declined moderately last week as the smaller than expected increase in CPI pressured yields, and the 10-year fell back into the 3.75% - 4.25% ‘stock positive’ range.

Special Reports and Editorial

Is the Rotation from Tech to the “Rest of the Market” Sustainable?

By far the biggest impact of last week’s CPI report was the massive rotation out of tech and tech-related sectors (tech, consumer discretionary, communication services) and into sectors that are 1) More sensitive to lower rates and 2) Cyclical in nature. This is best exemplified by the fact that the Russell 2000 surged almost 3.6% Thursday while the Nasdaq 100 dropped 2%, resulting in a massive 6% swing in their relative performance. But even considering that massive 6% swing, the Nasdaq is still outperforming the Russell 2000 by 15% YTD and that just underscores how badly cyclical and lower-rate-sensitive sectors have performed compared to AI-driven tech.

Further evidence of this rotation can be seen in the sector trading, as the only sectors to decline meaningfully were tech, consumer discretionary, and communication services (all tech and AI-related sectors). Consumer staples (XLP) declined 0.55% but that was because of disappointing earnings from Pepsi (PEP) and Conagra (CAG).

Every other sector in the S&P 500 traded solidly higher, led by real estate (XLRE) and utilities (XLU), which gained 2.7% and 1.8%, respectively. The reason for the rallies was clear: Those sectors have large dividends and stand to benefit if rates are now on a sustainable path lower. Similarly, small caps (IWM) also benefit from lower rates (again the Russell 2000 rose 3.6%). Other sectors that were higher included: materials (XLB up 1.4%), industrials (XLI up 1.3%), and energy (XLE up 1.3%). Those sectors are all cyclical, in that they do well when economic growth is accelerating, and, for Thursday at least, investors embraced the idea that a sustainable decline in rates will lead to more resilient growth and cyclical can do well.

So, can the sectors that led markets Thursday continue to outperform? In the near term, yes. The performance gap between tech and the rest of the market is so wide that it is reasonable to expect continued closing of that gap as markets more fully embrace the idea of the start of a rate-cutting cycle.

However, for this rotation to be sustainable beyond just a few weeks (and instead into the fourth quarter and end of the year) economic growth must remain resilient and we cannot have a growth scare. If we do have a growth scare, then cyclical sectors such as energy, industrials, materials, and financials will likely not do well (although defensive sectors such as utilities/REITs/staples and healthcare should relatively outperform).

So, whether one thinks this rotation and the “rest” of market outperformance can continue depends on one’s opinion on growth.

Because our investment team is more concerned about growth than the consensus, we are not inclined to think this cyclical/rest-of-market outperformance can continue and as such, we are not chasing value/cyclicals here.

Powell Testimony Takeaways

Fed Chair Powell testified before congress last week and there were two notable takeaways from his comments. First, Powell continued to say that all the Fed needs is some more “good” inflation data to be in a position to cut rates. That is dovish on its face, but it is also the same thing he has been saying for the past month-plus, and since a September rate cut currently has an 80% expectation from the market, that comment merely reinforced what is now widely expected, and as such it did not really move markets.

Second, if you read between the lines of Powell’s comments, it is clear the Fed is focusing on slowing growth, while the market still is not. Powell made several small comments to reflect this reality, including some comments on cooling in the labor market and again referring that risks to the outlook are balanced between inflation and growth. Yet perhaps the most notable comment was that inflation, “is not the only risk we face.”

We view Powell’s commentary as reinforcing our concern that the market is complacent to growth risks. That does not mean we are predicting a recession because we are not; however, we do think the chances of a growth scare continue to rise, and at this point, there is a growing disconnect between what the Fed is worried about (growth) and what the market is worried about (nothing, other than AI earnings).

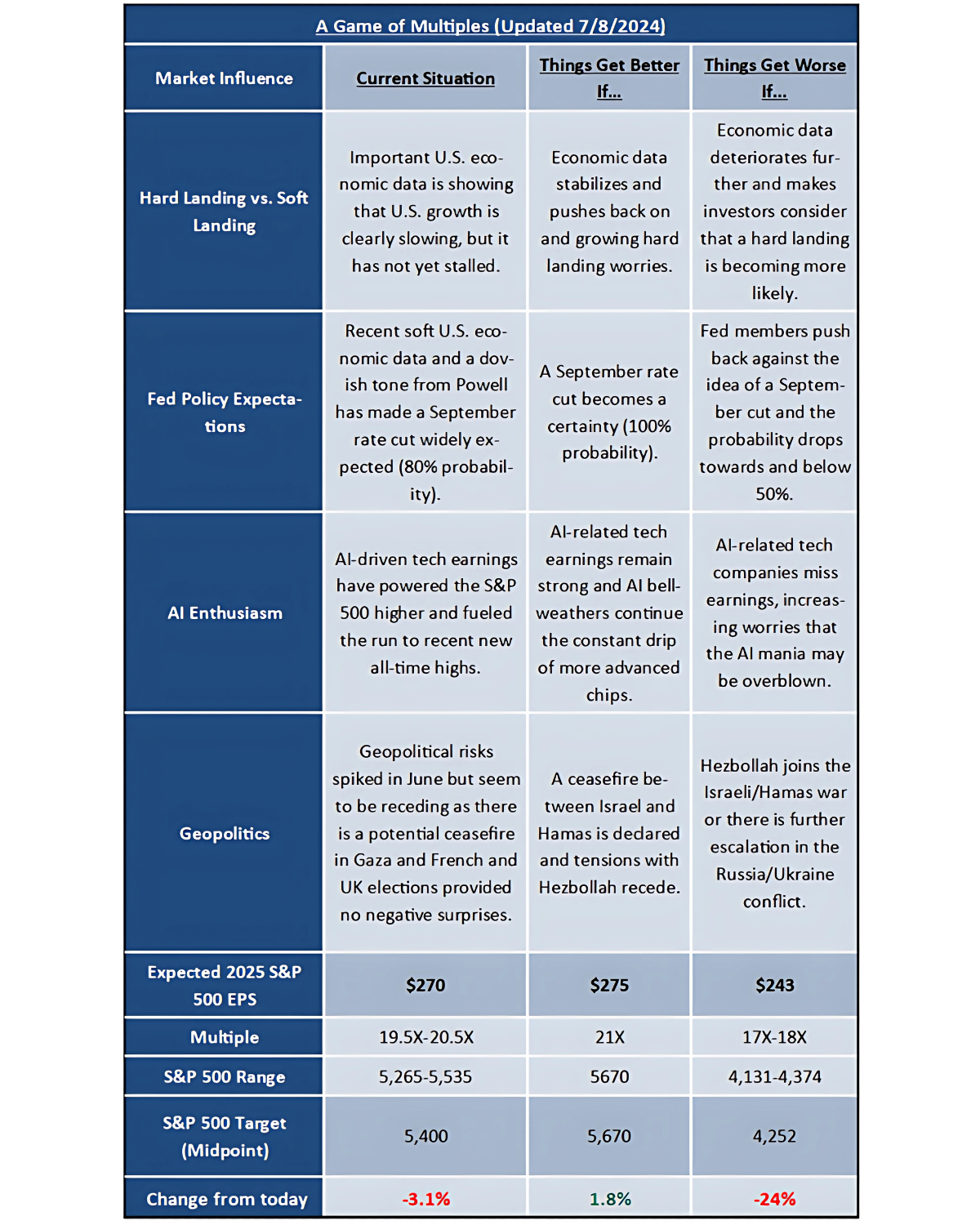

Market Multiple Table: An Important Change

For much of 2024, the S&P 500 has been trading solidly above any fundamental justified valuations, as a combination of rate cut hopes and AI earnings pushed the S&P 500 to the very limits of forward valuations. But the “market multiple” math just got a bit easier for the bulls, because around July of each year, analysts switch their earnings expectations from the current year to the next year, and in doing so the July Market Multiple Table now shows this market, at these levels, is reasonably valued as long as 2025 earnings estimates are correct!

To be more specific, consensus S&P 500 earnings for 2025 are around $270/share, solidly higher than the $243 estimate for 2024. And while this upcoming earnings season can change those numbers, for now, they are intact and as a result, the “fair value” of the S&P 500 using next year’s earnings has now leaped to the mid-5,000 range.

Importantly, this is not just a bookkeeping formality. Analysts value the market based on next year’s earnings and “next year” is now (or soon will be) 2025 earnings and based on those metrics, while the market is not cheap, it is no longer wildly above fundamental valuations (as it was before).

This change impacts investors in two ways. First, it does not remove the risk of a correction or pullback. Markets are still aggressively optimistic about a soft landing, aggressive Fed rate cuts, and resilient earnings. The net result is a high multiple (still around 20X). If growth slows more than expected or earnings fall, this market will drop.

Second, this earnings shift does make the YTD gains “stickier” in the event of a mild pullback. Put differently, current S&P 500 levels are a lot more justifiable using 2025 EPS (which is legitimate now). So, it is going to take real, negative news to cause a meaningful pullback in stocks (like a growth scare, fewer Fed rate cuts, geopolitical surprises, or AI disappointment).

Bottom line: The stock market has been trading at very aggressive valuations for much of 2024 and the change in earnings makes current market levels more justifiable. Additionally, it opens a credible path to another 5%-10% rally. However, the facts have not changed regarding the risks facing this market, and if there is legitimate negative news on one of the four market influences, a drop of 5% is possible. If there is a negative turn in multiple market influences, a drop of 10% or more is not just possible, it is likely.

Current Situation: Growth is slowing but not too slow and a soft landing is still expected, Markets widely expect the Fed to cut in September and twice in 2024, AI enthusiasm remains high, and geopolitical risks have eased slightly over the past month. The current situation reflects an environment that is still broadly supportive of stocks (and deserves a high multiple), but it is also leaving investors extremely vulnerable to a growth scare given that high multiple and recently soft economic data. And while the outlook for stocks is positive this market is still very aggressively valued given the current macroeconomic reality and at risk of a sudden, sharp pullback.

Things Get Better If: Economic data stabilizes, the Fed confirms a September rate cut, AI tech companies continue to beat earnings, and geopolitical risks decline. This would reflect a “perfect” environment for stocks of 1) Solid economic growth (so no slowdown), 2) Continued upward pressure on earnings expectations thanks to AI stocks, 3) Near-term rate cuts, and 4) Declining geopolitical risks. This environment could justify a 22X multiple in the markets (and 21X at least), which means “fair value” for the S&P 500 in this scenario is in the upper 5,000s.

Things Get Worse If: Economic data gets worse and points to a slowdown, AI-related tech companies miss earnings, the Fed pushes back on a September rate cut and geopolitical risks rise. This scenario would essentially undermine the assumptions behind much of the October-present rally and a giveback of much of the October-to-present rally would not be out of the question (that means a decline into the low 4,000s in the S&P). And while it seems like this outcome is not possible given still-elevated valuations, none of this is set in stone and this is a legitimate scenario we need to be mindful of, because it is possible if data breaks the wrong way.

Ready to Navigate These Markets Together?

Schedule your portfolio review to discuss how these market dynamics may impact your allocation strategy.

Schedule Your Review