- Address: 4975 Preston Park Blvd., Ste. #490, Plano, TX 75093

- Phone: (214) 983-0346

- Email: info@vannequitymanagement.com

Financial Market Insight

Highlights

Key Takeaways

- Navigating the Crosscurrents: A Look at the Year Ahead

- The Fed's Pivot: Unpacking the Shift in Monetary Policy

- Sector Spotlight: Identifying Opportunities in a Changing Landscape

- Global Headwinds: Assessing International Risks and Their Impact

Stocks

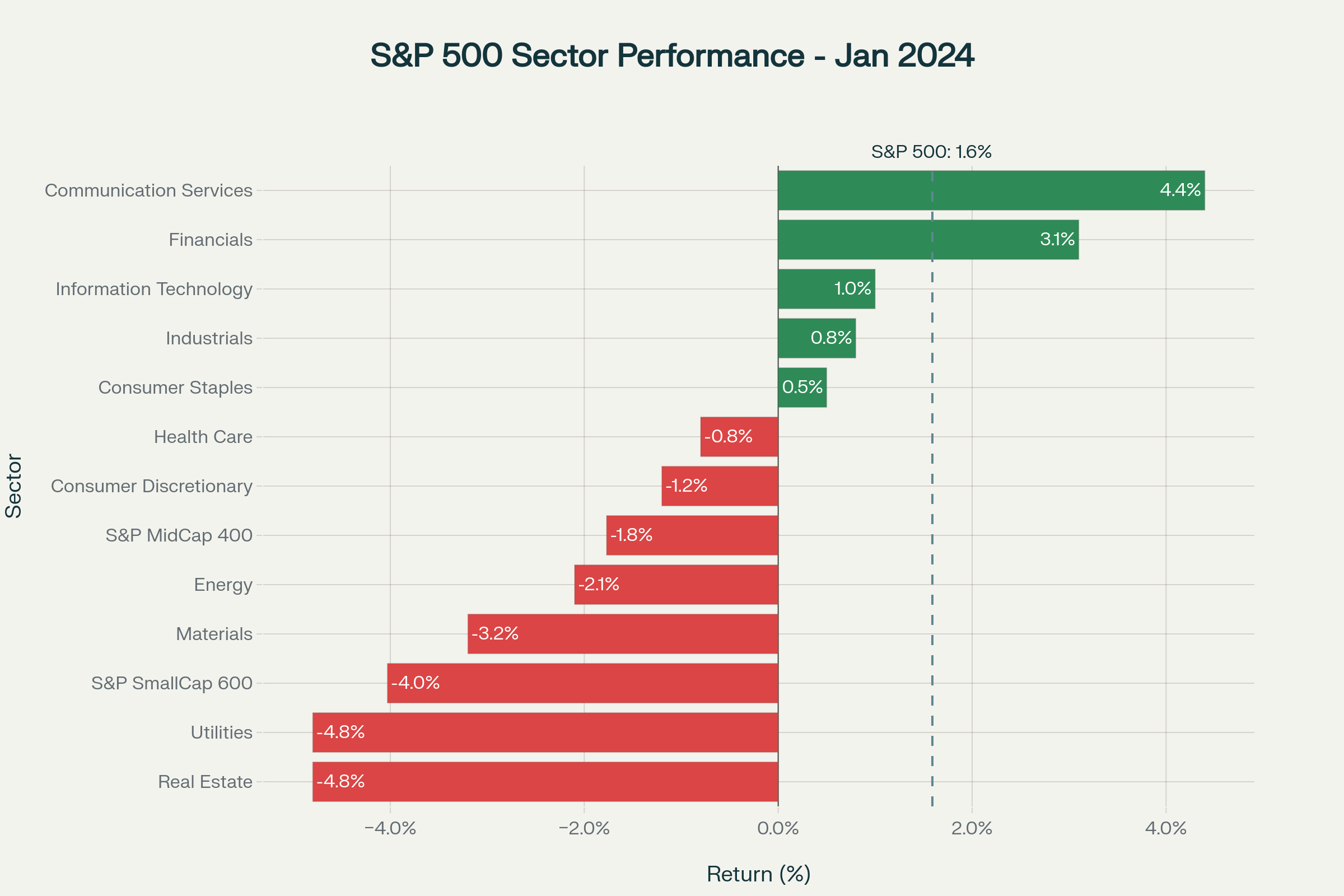

Equities started the year on a cautious note, as investors digested the significant gains from the end of 2023 and recalibrated expectations for the Federal Reserve's rate-cutting path.

✓ What is Outperforming: Quality and value factors showed resilience, along with defensive sectors like Healthcare and Utilities, as investors sought stability.

✓ What is Underperforming: High-growth technology and cyclical sectors that led the previous rally faced headwinds amid uncertainty over the timing and magnitude of Fed easing.

Navigating the Crosscurrents: A Look at the Year Ahead

As we embark on 2024, the investment landscape is defined by a complex interplay of optimism and caution. The market's strong finish to 2023 was largely fueled by the anticipation of a dovish pivot from the Federal Reserve. However, the initial weeks of January have served as a reminder that the path forward is unlikely to be linear. Inflation, while moderating, remains above the Fed's target, and the resilience of the labor market could lead to a more measured pace of rate cuts than many had priced in.

Our view is that the market is entering a period of consolidation. The "easy money" phase of the recovery, driven by falling inflation and the prospect of lower rates, is likely behind us. From here, fundamental drivers such as corporate earnings, economic growth, and fiscal policy will play a more crucial role in determining market direction. We are advising clients to adopt a balanced approach, focusing on quality companies with strong balance sheets and durable earnings streams.

Economic Data (What You Need to Know in Plain English)

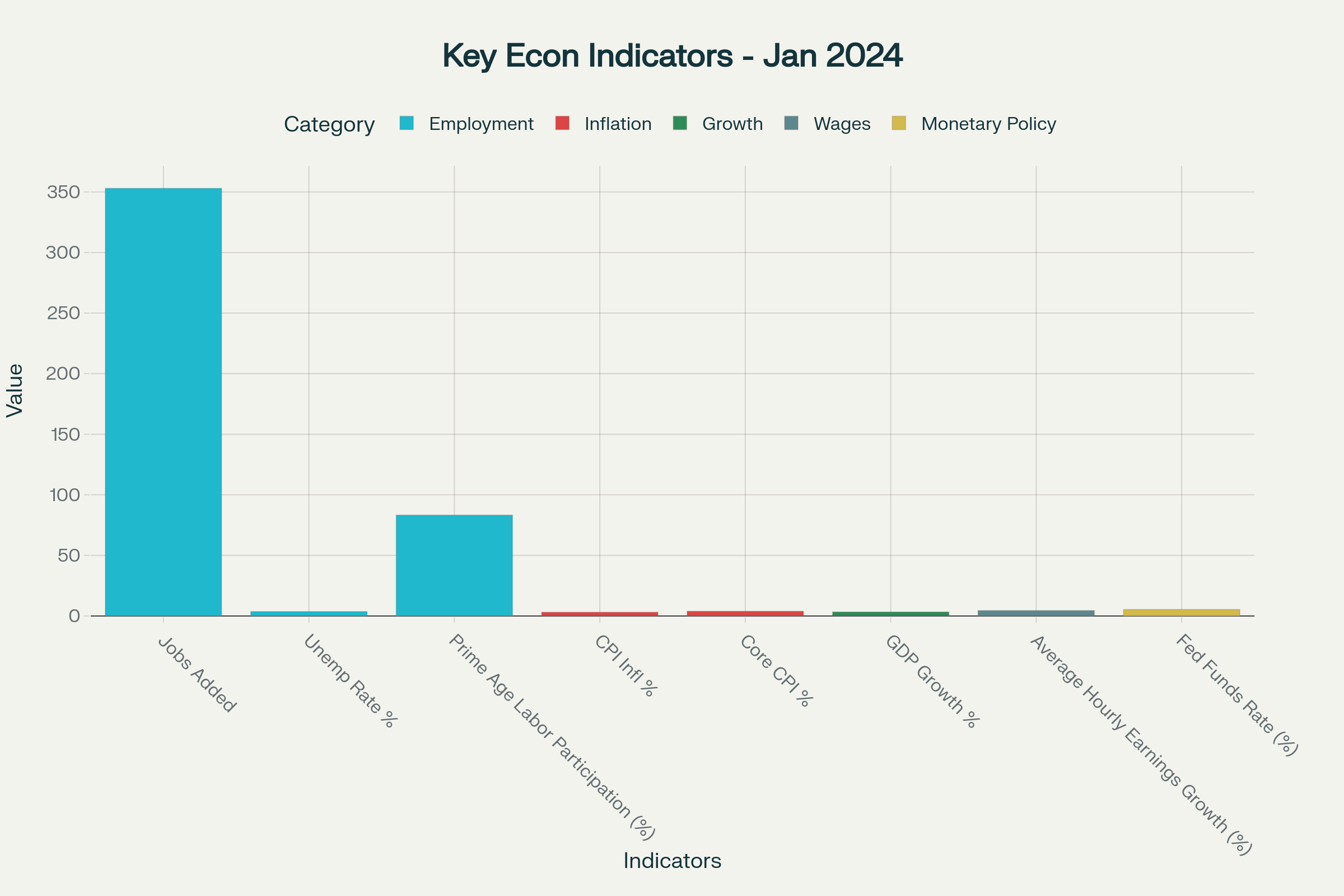

The economic data released in early January painted a picture of a resilient, but moderating, U.S. economy. The labor market, a key focus for the Federal Reserve, continued to show strength with the latest jobs report surprising to the upside. However, wage growth cooled slightly, providing some comfort to policymakers concerned about inflationary pressures.

Consumer spending, the bedrock of the U.S. economy, remained robust through the holiday season, though there are signs that households are becoming more discerning. Savings rates have declined, and credit card balances are on the rise, suggesting that the consumer may not be as insulated from higher interest rates as previously thought. The upcoming retail sales and consumer sentiment reports will be critical in assessing the durability of this trend.

On the inflation front, the latest CPI and PPI prints indicated that disinflation is continuing, but the "last mile" of getting back to the Fed's 2% target could be the most challenging. Shelter costs remain stubbornly high, and geopolitical tensions in the Middle East pose a risk to energy prices. The Fed will be watching this data closely as it contemplates the timing of its first rate cut.

Special Reports and Editorial

The Fed's Pivot: Unpacking the Shift in Monetary Policy

The most significant development for markets in late 2023 was the Federal Reserve's clear signal that its rate-hiking cycle has concluded and that cuts are on the horizon for 2024. This pivot has profound implications for all asset classes. For equities, lower rates can justify higher valuations and reduce borrowing costs for companies. For bonds, it signals an end to the brutal bear market and the potential for capital appreciation.

However, the key uncertainty is the timing and pace of these cuts. The market is currently pricing in a more aggressive easing cycle than the Fed's own projections suggest. This divergence creates a potential vulnerability for risk assets. If upcoming economic data forces the Fed to delay or scale back its planned cuts, it could trigger a market repricing. We believe a patient and data-dependent approach from the Fed is the most likely course, and we are positioning portfolios accordingly.

Ready to Navigate These Markets Together?

Schedule your portfolio review to discuss how these market dynamics may impact your allocation strategy.

Schedule Your Review