- Address: 4975 Preston Park Blvd., Ste. #490, Plano, TX 75093

- Phone: (214) 983-0346

- Email: info@vannequitymanagement.com

Financial Market Insight

Highlights

Key Takeaways

- Market Perspective: Navigating Uncertainty with Discipline

- Market Preview: Do tariffs start to boost inflation this month?

- July Market Multiple Table: Is the Good News All Priced In?

- Bitcoin & Crypto Update

Stocks

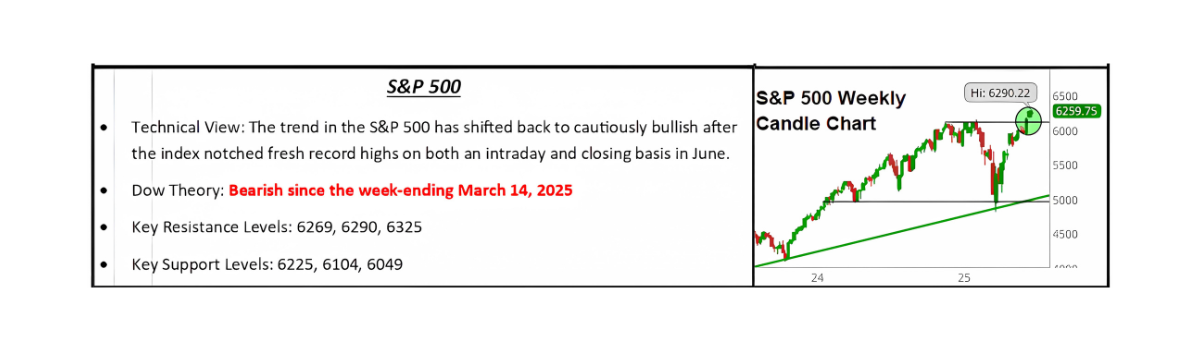

The S&P 500 hit new highs last week but then declined on Friday and was slightly lower on the week as trade tensions consistently escalated throughout the week and over the weekend.

✓ What is Outperforming: Defensive sectors, minimum volatility, and sectors linked to higher rates have been relatively outperformed recently as markets have become more volatile.

✓ What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

First and foremost, we hope you and your family enjoyed Happy Independence Day. This recent holiday serves as a reminder of the freedom and resilience that define the American spirit, and so much that we all have to live for. As we celebrate, we also want to express our sincere condolences to the many Texans who were and are currently affected by the devastating flooding in the southern part of our state. Our thoughts are with all those affected.

Market Perspective: Navigating Uncertainty with Discipline

As we move into the second half of 2025, financial markets remain a mixed bag… resilient in some areas, fragile in others. We are still in the midst of a complex transition: inflation continues to ease, but interest rates remain elevated; consumer confidence is improving, but global geopolitical risks continue to cast shadows over the outlook.

To kick off the beginning of the month, President Trump issued letters to several major U.S. trading partners, proposing a significant hike in tariffs. The proposal would raise baseline tariffs on all imported goods from 15% to 20%, up from the current average of about 10%. These new tariffs are scheduled to go into effect on August 1, pending implementation.

However, despite the dramatic headlines, markets barely reacted. The two main reasons are that investors do not believe the tariffs will actually happen, or if they do, they expect them to be rolled back quickly, as they were done earlier this year. The second is that markets ASSUME Trump will not take actions that will seriously damage the economy, especially with stock prices near record highs and growth remaining modest.

The key difference now conversely, the stock market is not punishing the policy threat; it is rewarding it, and Trump has taken note. In recent speeches, he has referenced the stock market's strength as a reason to go even further, suggesting that strong equity performance signals broad support for tariffs. He stated publicly, “People like the tariffs,” and pointed to new market highs as evidence.

This mindset, to our investment teams, introduces real risk. If market strength is interpreted as a green light, more aggressive trade actions MAY follow, and not because the economy can handle them, but because the political optics appear favorable.

So, what Is the Real Economic Risk?

Let us be clear: tariffs at the proposed levels, 15% to 20 % across the board, would be a massive shift in global trade policy. According to the Peterson Institute for International Economics, the average U.S. tariff in 2016 was just 1.6%. A jump to 15 % would be the highest rate since the 1930s.

Tariffs at that level would likely increase inflation, disrupt supply chains, and slow global growth. Major industries such as autos, electronics, agriculture, and retail would be hit hard. In fact, Goldman Sachs estimates that a 15% average tariff on imports could reduce U.S. GDP growth by 0.5% to 1% annually if fully implemented.

Markets may be underestimating the potential damage.

From a portfolio management perspective, this is not a time for fear, but it is a time for precision. It is not about chasing fads or overreacting to headlines. It is about discipline, data, and positioning portfolios for long-term durability in a world that no longer offers free money.

Key Themes We Are Watching Closely:

- Interest Rates and Fed Policy: The Federal Reserve has kept rates steady but maintains a hawkish tone. Markets are pricing in rate cuts, but we remain skeptical of any near-term pivot and are looking for only .25pt by year-end. Inflation is not fully tamed, and the Fed will likely error on the side of caution.

- Corporate Earnings and Valuation Stretch: While earnings have been strong in several sectors, particularly in the technology sector, the valuation gap between growth and value is now at historic extremes. We are starting to see signs of mean reversion, and we are positioning accordingly.

- Credit Markets and Liquidity Risks: We are seeing a quiet tightening of credit standards across banks and lenders. This often precedes a slowdown in capital investment and consumer borrowing. We continue to overweight quality and underweight speculative credit exposure.

- International Exposure: Despite U.S. market dominance over the past decade, select international markets (particularly in Asia and frontier economies) are becoming increasingly attractive from a valuation and demographic growth standpoint. International stocks have led performance to the upside year-to-date.

What This Means for Your Portfolio?

We remain focused on:

- Risk Management: Adjusting exposure to reduce correlation and maintain liquidity.

- Strategic Positioning: Staying overweight quality equities, underweight any deterioration of growth, and tactically allocating value sectors and individual names as appropriate.

- Tax Efficiency and Cash Flow Optimization: Maximizing after-tax returns through careful rebalancing and opportunistic harvesting.

We have been living through one of the most uncertain macroeconomic periods since the Great Financial Crisis, but also one of the most opportunity-rich. The winners will be those who stay patient, disciplined, and data-driven. As always, we are here to answer questions, review your strategy, and make adjustments as needed.

Economic Data (What You Need to Know in Plain English)

As we settle into the second half of July, economic momentum continues to grind higher, but investors would be wise not to make mistakes in calm for clarity. Last week was one of the quietest stretches in recent memory in terms of economic data, yet even in that calm, signals beneath the surface reminded us that nothing in this market should be taken for granted.

Jobless claims came in better than expected, with initial filings dropping to a multi-week low. This has become a familiar cycle: claims rise for a few weeks, hinting at a potential labor market breakdown, then reverse and settle back into the low 200,000s. This reinforces the narrative that the labor market remains intact. However, continuing claims told a different story, rising again to levels not seen since 2021. That means unemployed individuals are having a harder time finding work, and while this could be a leading indicator of weakness, it has been trending this way for over a year without triggering broader damage. For now, the labor market remains stable, but it deserves close attention.

The Federal Reserve’s meeting minutes also landed last week, and while some headlines tried to extract a dovish message, the reality was more neutral. A few members voiced openness to cutting rates as early as this month, but that is not the same as a majority view, and the overall tone remained cautious and data-dependent. The Fed’s “wait-and-see” stance remains intact, and market expectations continue to center on a potential cut in September, followed by a second move later in the year, assuming inflation stays in check (our Investment Committee is betting on a .25 pt by the end of the year).

However, the data vacuum ends now. This brings a series of pivotal reports that could quickly reshape market sentiment, especially around inflation and consumer strength. All eyes are on Tuesday’s Consumer Price Index, which is the single most influential data point for near-term monetary policy. Core inflation needs to stay cool. If we see any move back toward 3 percent or higher, the logic supporting a September rate cut will unravel quickly. Bond yields would rise, and concerns that tariffs are feeding inflation could reignite volatility, especially with the August 1 deadline for new trade actions looming.

Later in the week, attention turns to consumer spending. Retail sales will give us a direct read on whether the engine of the U.S. economy is still humming. So far, the consumer has defied skeptics, showing resilience in the face of higher prices, tighter credit, and persistent rate pressure. If that continues, it supports the narrative of a soft landing of slow but sustainable growth. If it cracks, the entire economic outlook will have to adjust.

Additional updates on manufacturing activity and labor market health will also hit the tape. While these smaller surveys and weekly claims data are noisy, large surprises in either direction can be early indicators of shifting momentum. Together, they will either reinforce the idea that growth is cooling in an orderly way or that the Fed has a bigger problem on its hands than markets are currently pricing in.

For now, the foundation remains solid. Labor is steady. Spending has not yet rolled over. Inflation, while still sticky, has cooled from its peak. If this week’s data cooperates, it will further anchor the current rally. But if the numbers disappoint, especially on inflation, the market will quickly reprise, and risk appetite will dry up just as quickly as it returned.

As always, we are watching these developments closely and are ready to adjust positioning if the data calls for it. Please contact us if you would like to schedule a mid-year review or discuss how these dynamics may impact your allocation strategy.

Special Reports and Editorial

July Market Multiple Table: Is the Good News All Priced In?

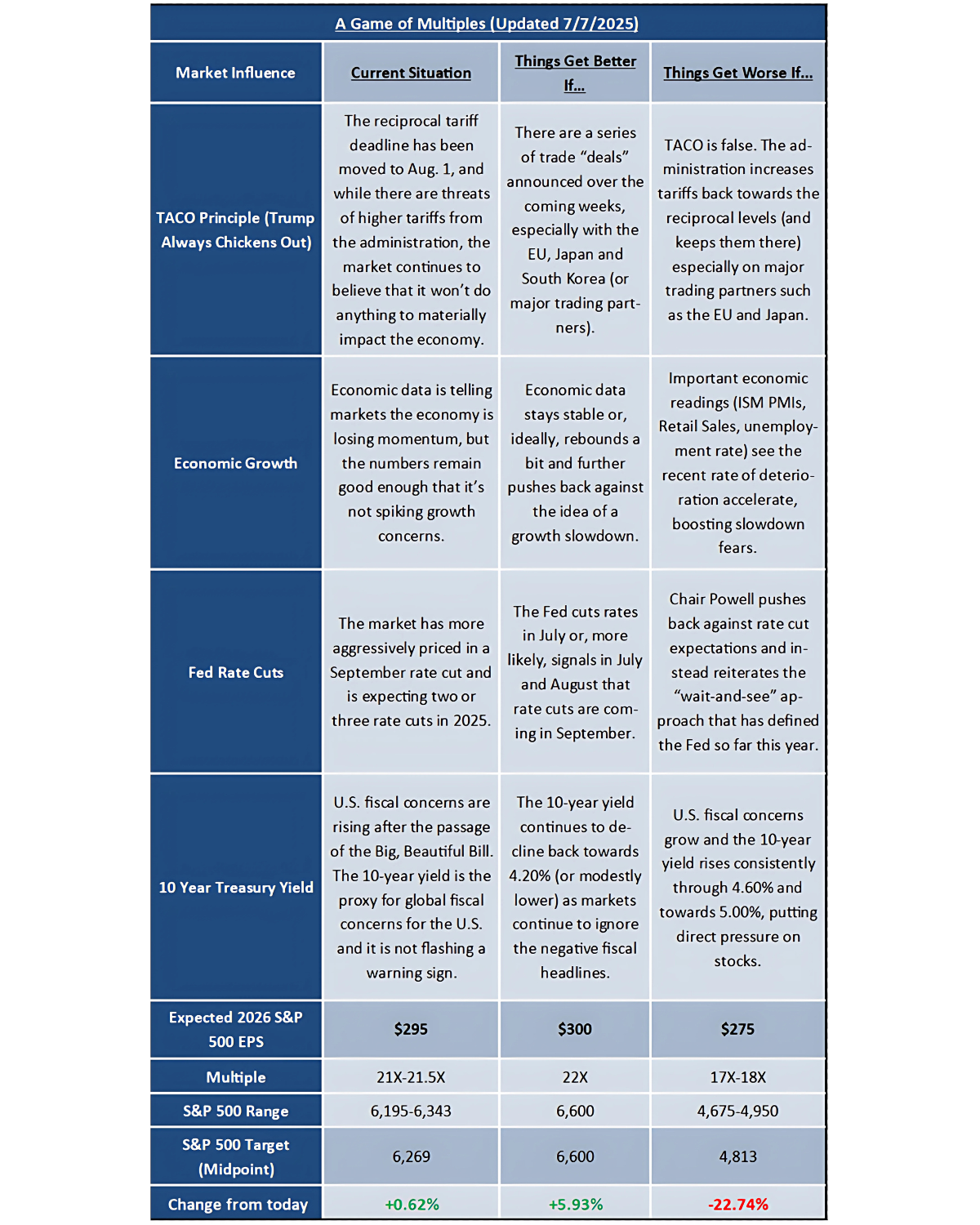

The July Market Multiple Table largely reinforces our fundamental view of this market: In the short term, a series of positives has pushed stocks legitimately higher. But at this point, the market is assuming almost universally positive resolution of the major issues impacting them, as well as above-average annual earnings growth, and if any of those assumptions are incorrect, then any drop towards fundamental support could easily reach 10% on a pullback.

What has changed? Earnings and Fed Rate cuts. The first important change to the July MMT compared to June is the adoption of 2026 S&P 500 earnings estimates (at the bottom of the table). The consensus S&P 500 earnings expectation for 2026 is $295/share (Factset), which is up some 30-ish dollars from the 2025 S&P 500 earnings estimate, which is around $265. That’s more than 10% earnings growth and solidly above the 7%-8% longer run average. Positively, this switch to 2026 numbers makes the S&P 500 more justifiably valued at current levels (although still expensively valued historically). Nevertheless, that aggressive earnings growth seems especially bold, given the unknown impacts of tariffs, delayed Fed rate cuts, and an economy that is clearly losing momentum. Short term, the switch to 2026 numbers (which is appropriate given the calendar) eases the valuation issues with this market, but underscores just how much good news is already priced into stocks.

The second notable change in the MMT is that expectations for Fed Rate Cuts have replaced inflation as a market influence. Importantly, that does not mean inflation will not still impact this market if CPI or the Core PCE Price Index jump, but it does reflect the fact that over the past month, market expectations for a rate cut in September have helped power stocks higher. Our team thinks that rate-cut expectations were a major contributor to the “melt-up” we saw in stocks during the last two trading weeks of June. The market now expects two to three rate cuts from the Fed this year, with the first coming in September. That expectation has helped the S&P 500 hit new highs, but it also creates the potential for disappointment if Powell sticks to the “wait-and-see” policy the Fed has employed YTD.

What’s the MMT Say About Valuations? The rally to new highs is justified by fundamental positives, but at these levels, the market continues to assume a lot of positive resolutions on key market unknowns (trade, economic growth, Fed rate cuts, fiscal concerns, and earnings growth).

For the past several weeks, our investment team has said the market’s rally has been, in part, driven by an early “switch” for 2026 S&P 500 EPS numbers and the July MMT validates that statement, as the valuation of the market using 2026 earnings is more appropriate given the current set up. To that point, there has been legitimate positive news over the past several weeks: Easing trade risks, stable growth, the likelihood of near-term rate cuts, and geopolitical de-escalation. That, combined with momentum, legitimately pushes stocks higher.

But the S&P 500 is now trading above 2026 S&P 500 earnings, earnings that assume substantial year-over-year growth (above 10%) and, even then, leave only a bit of upside if we get a near-perfect resolution on tariffs, economic growth, Fed policy, global bond yields, and earnings. Our team is not saying that is possible, but we are saying that a lot of the good news that can happen over the next six months is now mostly priced into stocks. That does not mean stocks have to decline, but it does mean they are vulnerable to disappointment on a series of fronts (again, tariffs/trade, growth, Fed rate cuts, rising yields, and earnings). That is the mindset we have to be in right now in this market: Yes, there have been some positives, and stocks are not ridiculous at these levels. But we are once again in a situation where any disappointment on the major influences will cause an air pocket-type decline of at least 5% (and probably more).

Current Situation: TACO remains in place and is helping the market to ignore tariff threats, deadlines, and most other controversial economic headlines. Economic growth continues to slow but is still “ok.” Markets do fully expect a September rate cut (and another one or two before year-end), and despite the Big, Beautiful Bill passing, the global bond markets are not expressing any fiscal concerns. This environment represents a positive resolution (albeit temporary) to more market influences, and as such, the rally to new highs is fundamentally legitimate, although now the market is pricing in a near-best-case scenario.

Things Get Better If: There are a series of trade deals announced over the coming weeks that further reduce tariff risks, economic growth remains stable or rebounds, the Fed signals rate cuts are coming in September (or does a surprise cut in July) and the 10-year yield stays around or below 4.50%, reflecting fiscal calm despite the Big, Beautiful Bill. This is basically a perfect outcome for markets and would almost certainly fuel a move towards the mid-6,000s in the S&P 500.

Things Get Worse If: TACO is invalidated and reciprocal tariffs rise, economic growth slows further and increases slowdown concerns, the Fed does not cut rates and sticks with “wait and see,” and the Big, Beautiful Bill increases fiscal concerns and pushes the 10-year Treasury yield towards 4.60%. This outcome would effectively reverse the positive progress over the past two months and put trade-war-driven stagflation back on the table and resulting in a sharp decline in stocks and bonds.

Bitcoin & Crypto Update

We offer an update on the Bitcoin/crypto landscape, because while it is not appropriate for all clients, it is becoming an increasingly popular asset. Therefore, we want to make sure you are kept up to speed on events in this market, so any conversation about Bitcoin/cryptos can be an opportunity to impress.

- Bitcoin Milestones: 1) Bitcoin stayed above $100K for 30 consecutive days for the first time ever. 2) ~99% of Bitcoin addresses were in profit. 3) Bitcoin supply on exchanges fell to a new low.

- Domestic State Bitcoin Adoption: U.S. state officials discussed, proposed, advanced, or passed legislation to add Bitcoin as a strategic reserve asset, including Arizona (the state’s House of Representatives approved House Bill 2324, creating a framework for a “Bitcoin and Digital Assets Reserve Fund” – awaiting Gov. Hobbs’ signature), Ohio (time to establish a state Bitcoin reserve, according to Rep. Demetriou, with House Bill 18 in committee) and Texas (the third U.S. state to adopt a Bitcoin reserve fund after Gov. Abbott signed SB 21 into law). In contrast, Connecticut enacted a new law banning state and local governments from holding, investing in, or accepting crypto assets.

- Industry Advances: 1) Renowned financial advisor Ric Edelman recommended investors allocate between 10% and 40% of their portfolios to crypto. 2) Kraken launched Kraken Prime (offering institutional clients access to crypto trading, custody, and financing through a single platform) and Krak (a P2P payments app enabling users to send and receive payments in 300+ currencies, including cryptos, to 110 countries.) 3) SoFi will relaunch spot trading for BTC and ETH later this year. 4) FTSE Russell, Eurex, and CBOE launched nano and reduced-value crypto futures (more cost-effective) for Bitcoin and Ethereum. 5) Chainlink teamed up with payments provider Mastercard to allow the credit card company’s 3B cardholders to buy crypto on-chain. 6) The Bank of Russia announced that financial institutions can now offer crypto-linked derivatives to qualified investors. 7) A Coinbase survey reported that blockchain initiatives have been adopted by 60% of Fortune 500 companies (with 20% of executives considering on-chain initiatives a key part of their long-term strategy, up 47% from last year)… A third of small- and medium-sized U.S. firms are now using crypto (2X the number in 2024)… And more than 80% of institutional investors plan to increase their crypto exposure this year.

- Noteworthy ETF News: 1) South Korean authorities submitted a detailed roadmap for the approval of spot crypto ETFs. 2) JPMorgan plans to accept crypto ETF shares as collateral for loans and include crypto holdings in clients’ net worth assessments. 3) New launches: Global X Bitcoin Covered Call ETF (BCCC), Nicholas Crypto Income ETF (BLOX), REX MSTR Growth & Income ETF (MSII), REX COIN Growth & Income ETF (COII), and Bitwise GME Option Income Strategy ETF (IGME). 4) Multiple issuers filed – or saw proposals advance – for a variety of crypto ETFs, including Yorkville America Digital/Trump Media & Technology Group (BTC), Trump Media & Technology Group (BTC+ETH), CoinShares (SOL), Invesco/Galaxy Digital (SOL), 21Shares (SUI), ProShares (CRCL leveraged) and Bitwise (CRCL option income). 5) The SEC extended review periods for multiple crypto ETF proposals to July, including Bitwise’s DOGE ETF, Grayscale’s DOT ETF, Canary Capital’s HBAR ETF, and multiple Solana ETF filings.

- Notable IPO Activity: Stablecoin issuer Circle went public on the NYSE, rallying 750% in less than three weeks since its IPO. Crypto exchange Gemini filed a confidential S-1 with the SEC for a potential IPO. Crypto exchange Bullish confidentially filed paperwork with the SEC for an IPO. Crypto exchange OKX is considering a U.S. IPO. Crypto prime brokerage FalconX is pondering an IPO. Crypto custody firm BitGo is considering an IPO. Crypto trading platform Uphold is exploring a potential U.S. IPO. Justin Sun-founded blockchain project Tron reportedly plans to go public through a SPAC.

- Stablecoin Interest: Numerous companies are exploring the use of their own stablecoins or allowing stablecoins as payment options, including Amazon, Apple, Airbnb, X, Shopify, Uber, Walmart, JPMorgan, DTCC, Societe Generale, Deutsche Bank, SoFi, Stripe, Fiserv, Revolut, KB Kookmin (South Korea’s largest bank), Shopify, Ant International, and JD.com.

- Regulatory Moves: 1) The U.S. House Committee on Financial Services advanced the CLARITY Act, a crypto market structure bill, which heads to the full House floor for a vote. 2) The U.S. Senate advanced the GENIUS Act, the country’s first stablecoin regulatory framework, which heads to the House. 3) The Federal Reserve eliminated “reputational risk” as a factor in bank exams, aligning with the OCC and FDIC in removing a key regulatory barrier that critics say fueled discriminatory debanking of crypto firms. 4) The U.S. Federal Housing Finance Agency issued an order to count Bitcoin (and crypto) as an asset for a mortgage, also directing Fannie Mae and Freddie Mac to consider the cryptocurrency assets of borrowers for the purposes of collateral on single-family home mortgage loans. 5) International headway: Brazil, UK, Japan, Hong Kong, South Korea, Vietnam, Thailand, Philippines, Malaysia, Pakistan, and Kazakhstan all took steps towards backing or advancing digital assets or blockchain technology.

Ready to Navigate These Markets Together?

Schedule your portfolio review to discuss how these market dynamics may impact your allocation strategy.

Schedule Your Review