Energy's Game of Thrones: Power Plays in the 2025 Energy Kingdom

Author: Vann Equity Management Team

Date: September 18, 2025

Reading Time: 12 minutes

🔋 Executive Summary

KEY TAKEAWAYS:

- The energy sector in 2025 mirrors a high-stakes medieval drama with traditional oil majors defending their kingdoms while renewable energy challengers mount an aggressive assault.

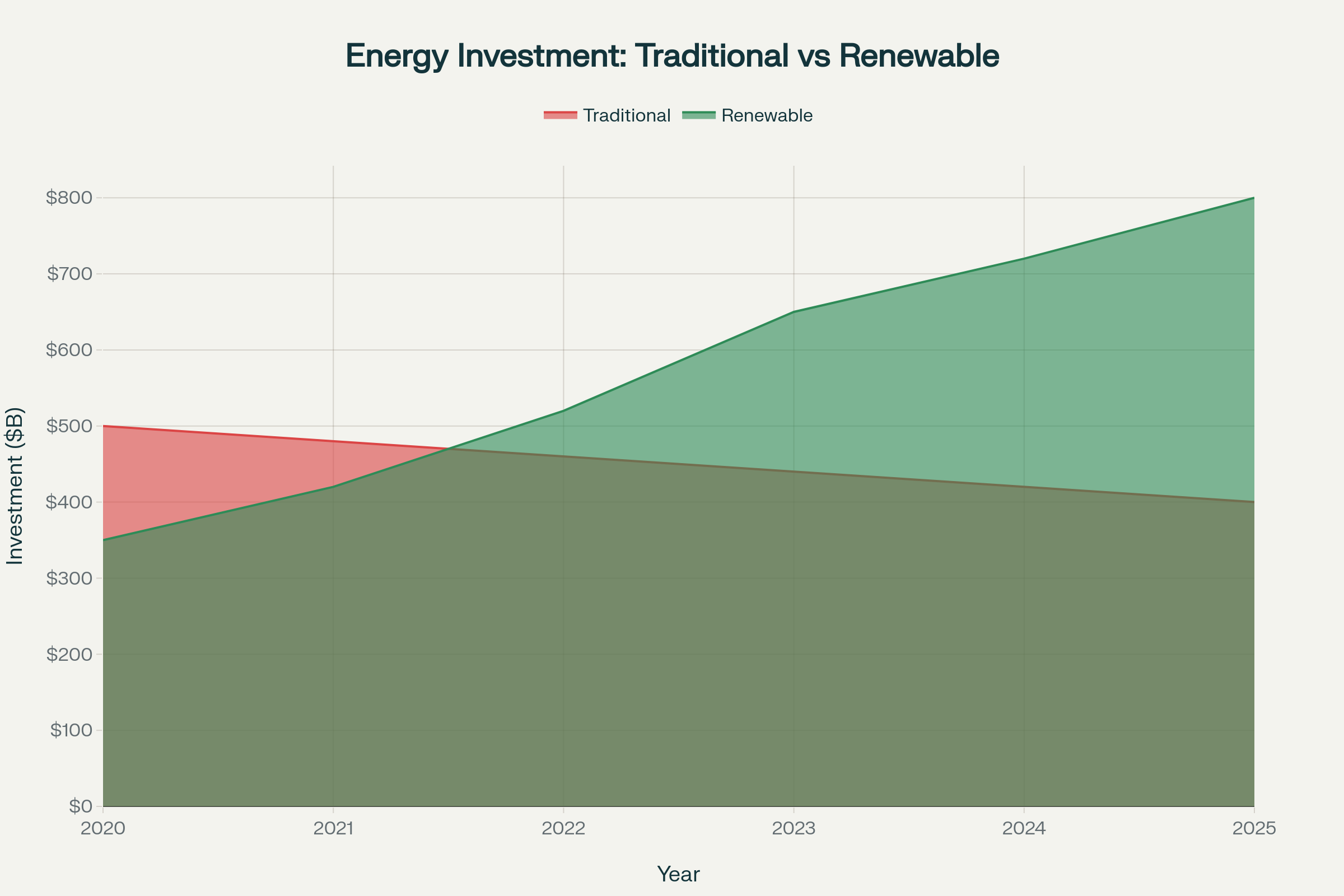

- Renewable investments have reportedly reached $800 billion in 2025, while traditional energy capex declined to $400 billion, potentially marking a historic inflection point.

- Nuclear energy may be experiencing an unexpected renaissance with reported 63% public support, up from 43% in 2020.

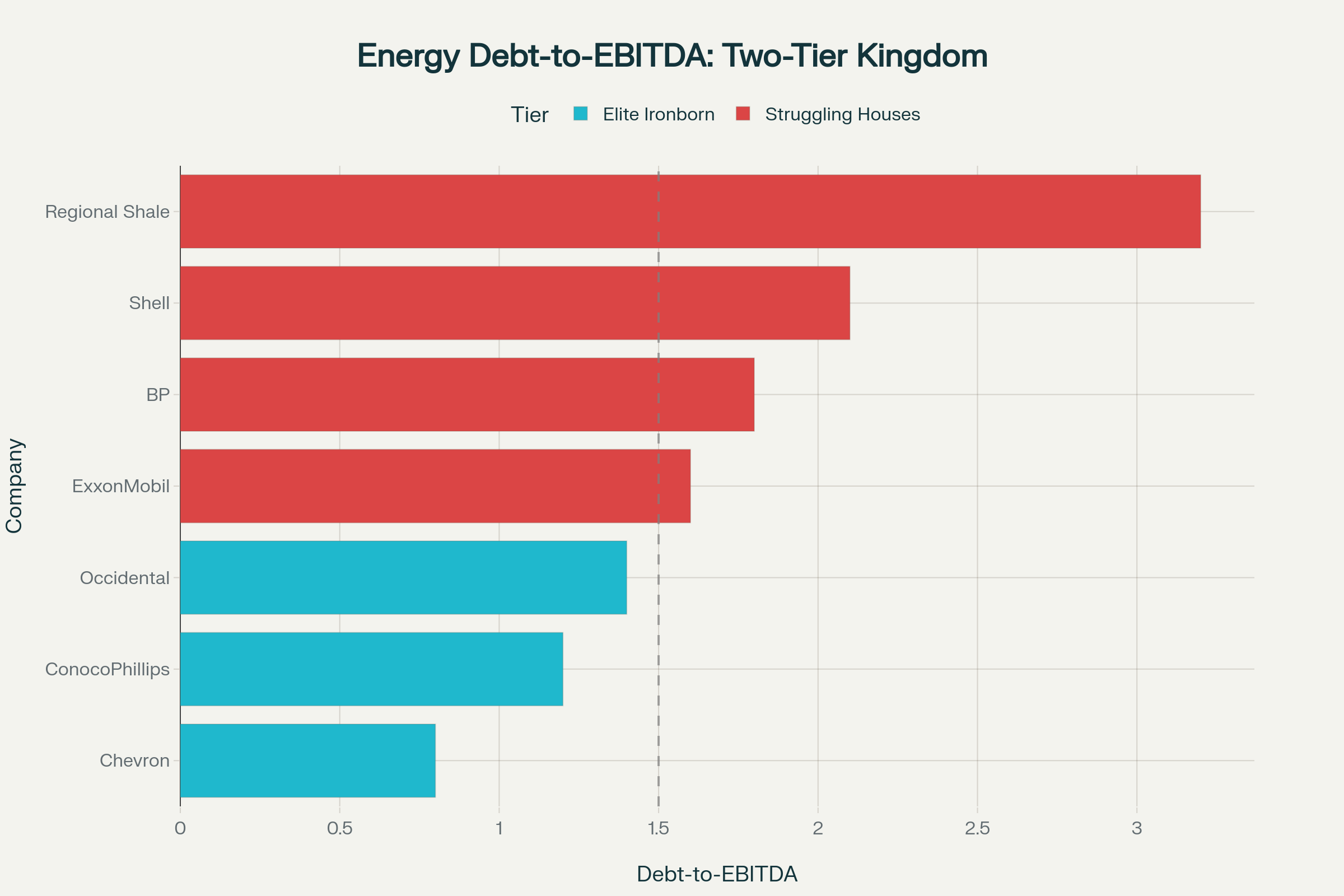

- Financial discipline appears to create a two-tier market where companies with debt-to-EBITDA below 1.5x may enjoy 25-40% valuation premiums.

Introduction: Winter Is Here for Traditional Energy

In 2025's energy markets, winter isn't coming—it's here. And only the strongest houses will survive. Welcome to the real-life Game of Thrones, where instead of Lannisters and Starks, oil majors and renewable disruptors battle for the energy kingdom.

This comprehensive market analysis breaks down the complex state of play in today's energy sector investment opportunities. We'll explore which companies may claim the Iron Throne, emerging wild cards, the influence of "the Iron Bank" (capital markets), and the risks that might spark a Red Wedding in the energy markets. Understanding these power dynamics and energy transition portfolio management strategies could be crucial for investors. For foundational concepts, consider reviewing our ABCs of Stock Market Investing guide.

Figure 1: The Great Houses of Energy - Major Players in the 2025 Energy Kingdom

⚔️ The Great Energy War: Traditional vs. Renewable Investment (2020-2025)

The Shifting Balance of Power

As the Great Houses of energy resources shift their armies, new titans may be crowned while old empires potentially wane. Current renewable energy portfolio allocation strategies suggest a surge in clean energy investments, while traditional fossil fuel investments face strategic retrenchment.

Figure 2: Traditional vs Renewable Capital Flows (2020-2025)

The Great Houses: Traditional Energy's Fight For Relevance

Oil and Gas Investment Analysis 2025

Formerly untouchable, oil & gas majors are locked in what some analysts view as an existential struggle. European majors now reportedly funnel an average of 33–35% of capex to renewables, green hydrogen, and carbon capture projects[1]. Shell has reportedly doubled its renewable operating portfolio since 2020.

*Past performance does not guarantee future results. All investments involve risk of loss.

"Financial discipline is the new moat. The era of overleveraged energy giants is over." —Ewa Malz, Fitch Ratings, 2025

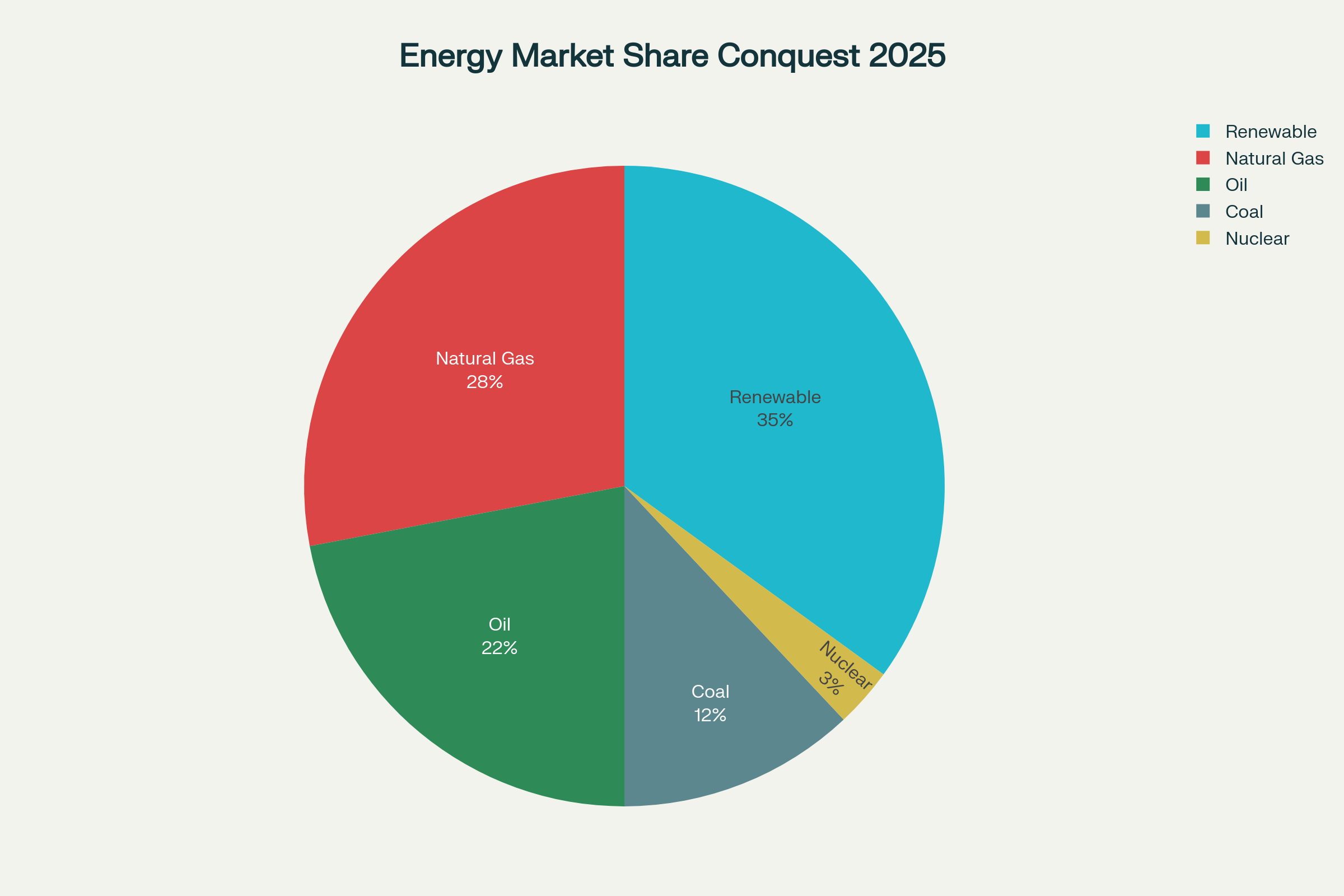

⚔️ Houses of Energy: Market Share Conquest 2025

Figure 3: Houses of Energy Market Conquest - Sector Distribution in 2025

Understanding the Energy Sector Market Outlook September 2025

The current market share distribution potentially reflects a kingdom in transition. Renewable energy's growing dominance may reshape investment strategies for years to come.

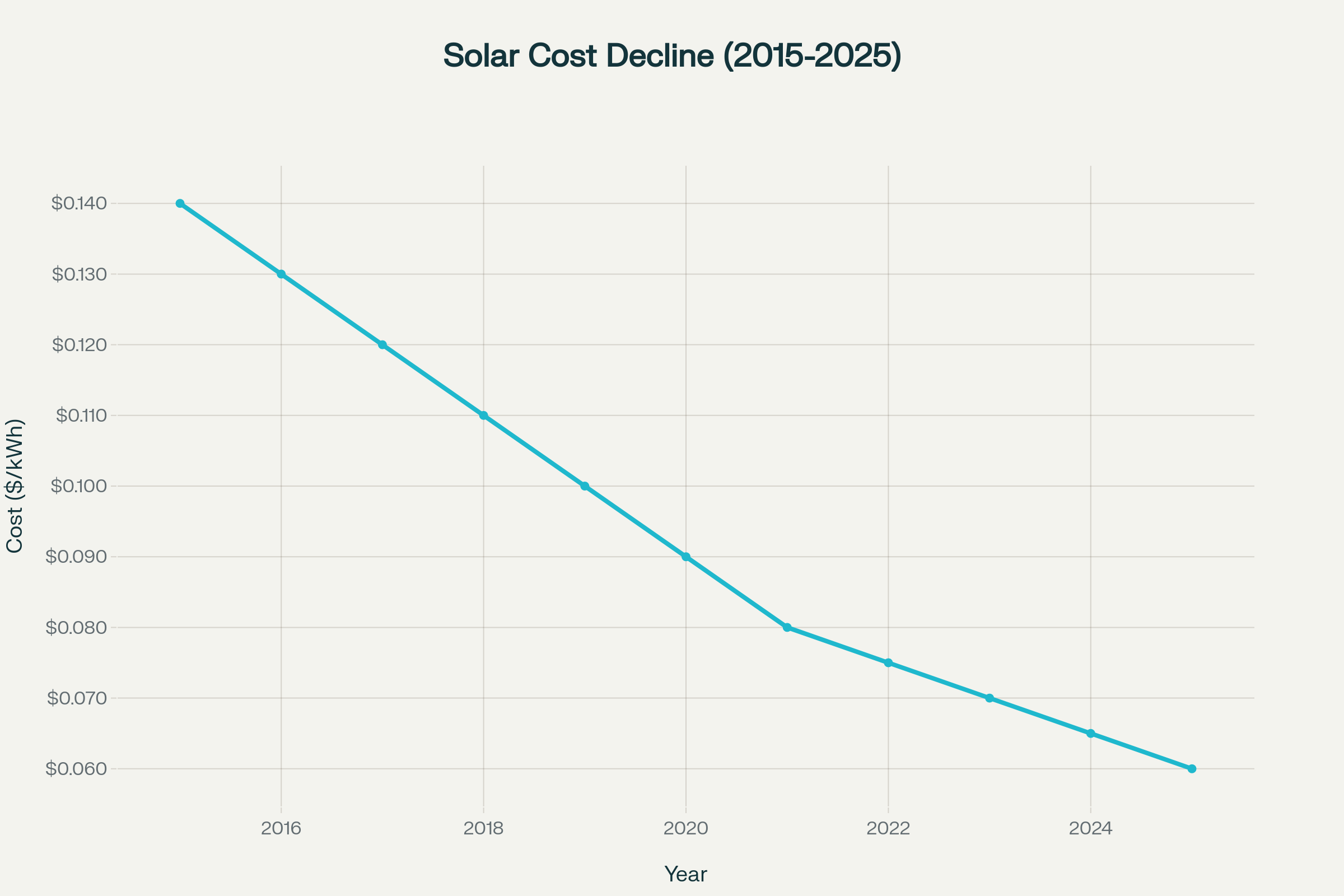

🐉 The Dragon Riders: Renewable Energy's Airborne Assault

Solar and wind continue their market expansion. Utility-scale solar costs—now reportedly under $0.06/kWh—have fallen more than 60% since 2015[4].

Figure 4: Dragon Power - Solar Cost Destruction (2015-2025)

Policy & Geopolitics in Energy Infrastructure Funds

| Region | Policy Initiative | Investment Impact |

|---|---|---|

| EU | Fit for 55 acceleration | €1 trillion green infrastructure push |

| US | Inflation Reduction Act bonuses | Homegrown supply chain boom |

| China | Dual approach: renewables + coal | Manufacturing dominance with resilience focus |

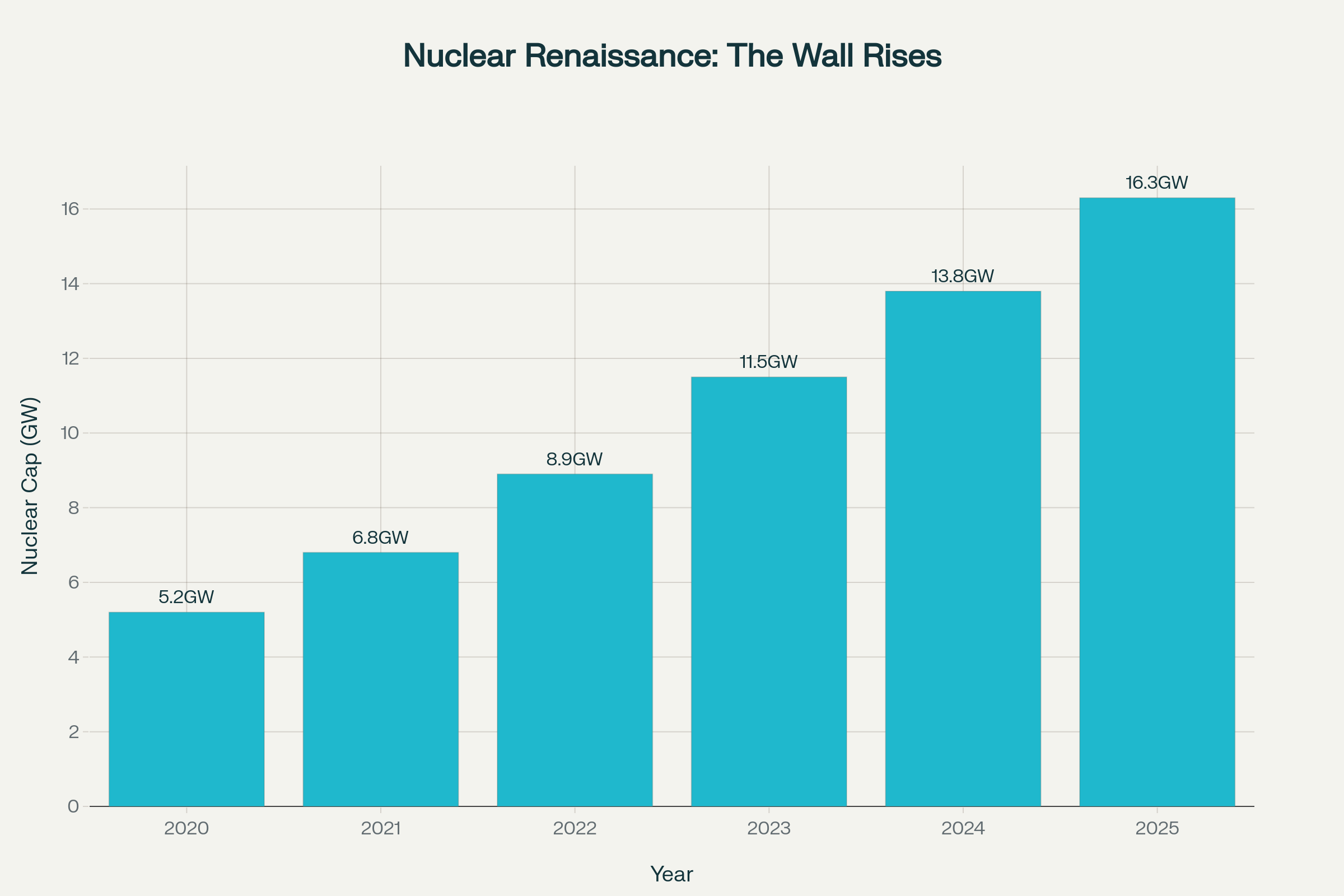

🏰 The Night's Watch Returns: Nuclear Energy Investment Renaissance

Like the Night's Watch—exiled but quietly powerful—nuclear energy investment opportunities have potentially returned from the policy wilderness. The first U.S. and Canadian small modular reactors (SMRs) reportedly started commercial operations in late 2024. 2025 polling suggests 63% of Americans may now support nuclear, up from 43% in 2020[7].

Figure 5: Nuclear Renaissance - Capacity Additions Rise Again

💡 Investment Strategy Note

Emerging technologies in energy represent both opportunities and risks. Consider how these innovations might fit within your overall energy transition portfolio management approach. Diversification across traditional and emerging energy sectors may help manage volatility.

⚡ Looking Ahead: Investment Strategy Considerations

The energy Game of Thrones will likely rage for years. The most successful investors might be those who recognize that the transition could be both inevitable and unpredictable. Consider these factors for energy sector investment opportunities:

- Diversification: Balance across traditional and renewable sectors

- Financial Health: Focus on companies with strong balance sheets

- Technology Exposure: Consider emerging technologies like hydrogen and storage

- Geographic Spread: Global energy transition creates regional opportunities

- Risk Management: Hedge against volatility with varied investment vehicles

*These are general educational observations, not personalized investment advice. Consult with a qualified advisor for strategies tailored to your situation.

Get Personalized Energy Sector Investment Guidance

Understanding market trends is just the beginning. Discover how current energy sector conditions could affect your specific portfolio and investment goals.

Schedule Your ConsultationCall us at (214) 983-0346 for immediate assistance

Do not forget our ABCs of Stock Market Investing: A Beginner’s Guide for simple building blocks every investor should know.