Financial Market Insight

Highlights

Key Takeaways

- Four Key Areas of Policy and Politics That Matter Most to Markets

- Economic Numbers: What you need to know

- Market Multiple Table (January Update)

- Can Stocks Go Back-to-Back-to-Back?

- Hard Landing/Soft Landing Scoreboard

Stocks

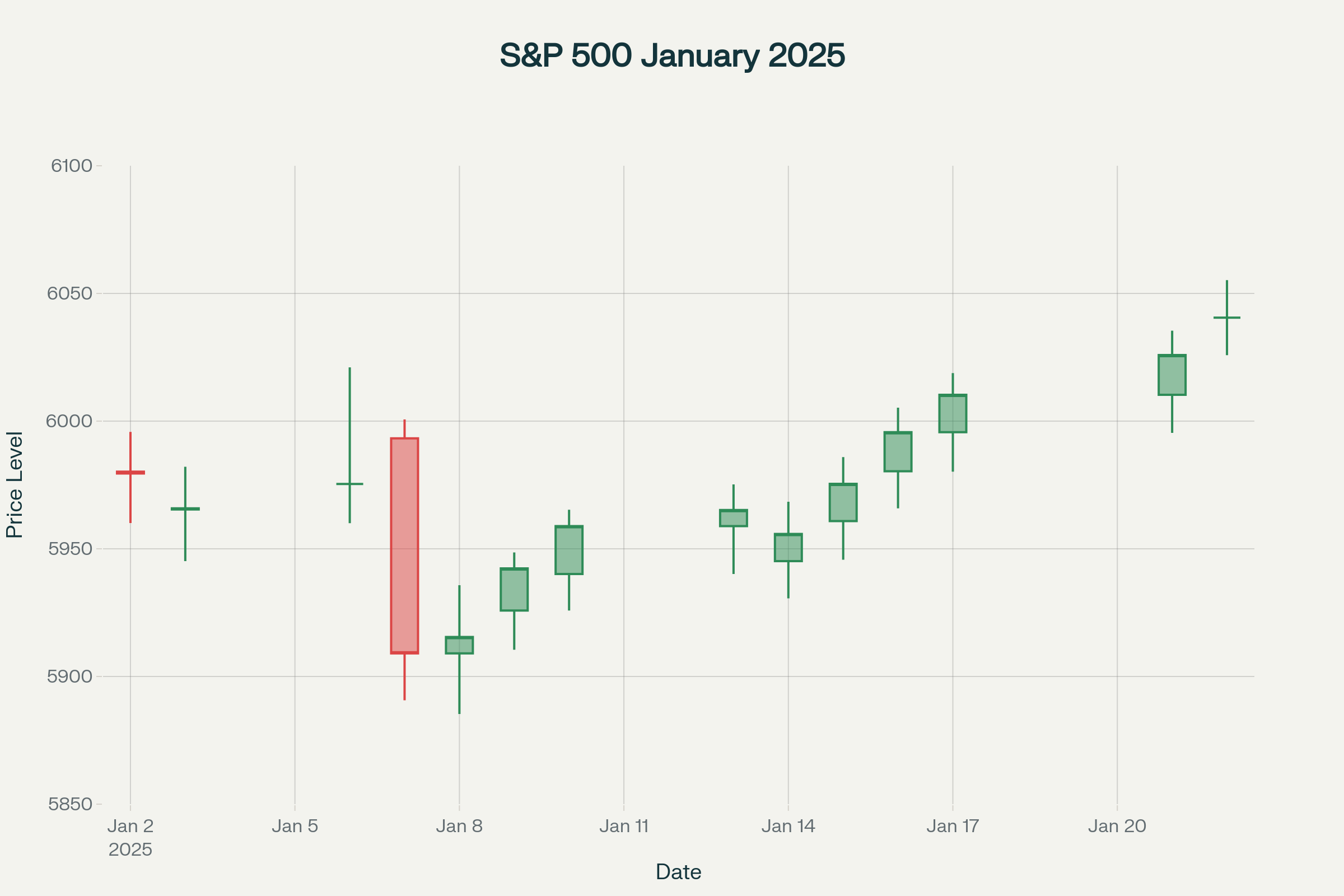

Stocks rebounded last week thanks to better-than-feared CPI/PPI data that eased worries the Fed was about to pause rate cuts.

✓ What is Outperforming: Defensive sectors, minimum volatility, and sectors linked to higher rates have been relatively outperformed recently as markets have become more volatile.

✓ What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

Four Key Areas of Policy and Politics That Matter Most to Markets

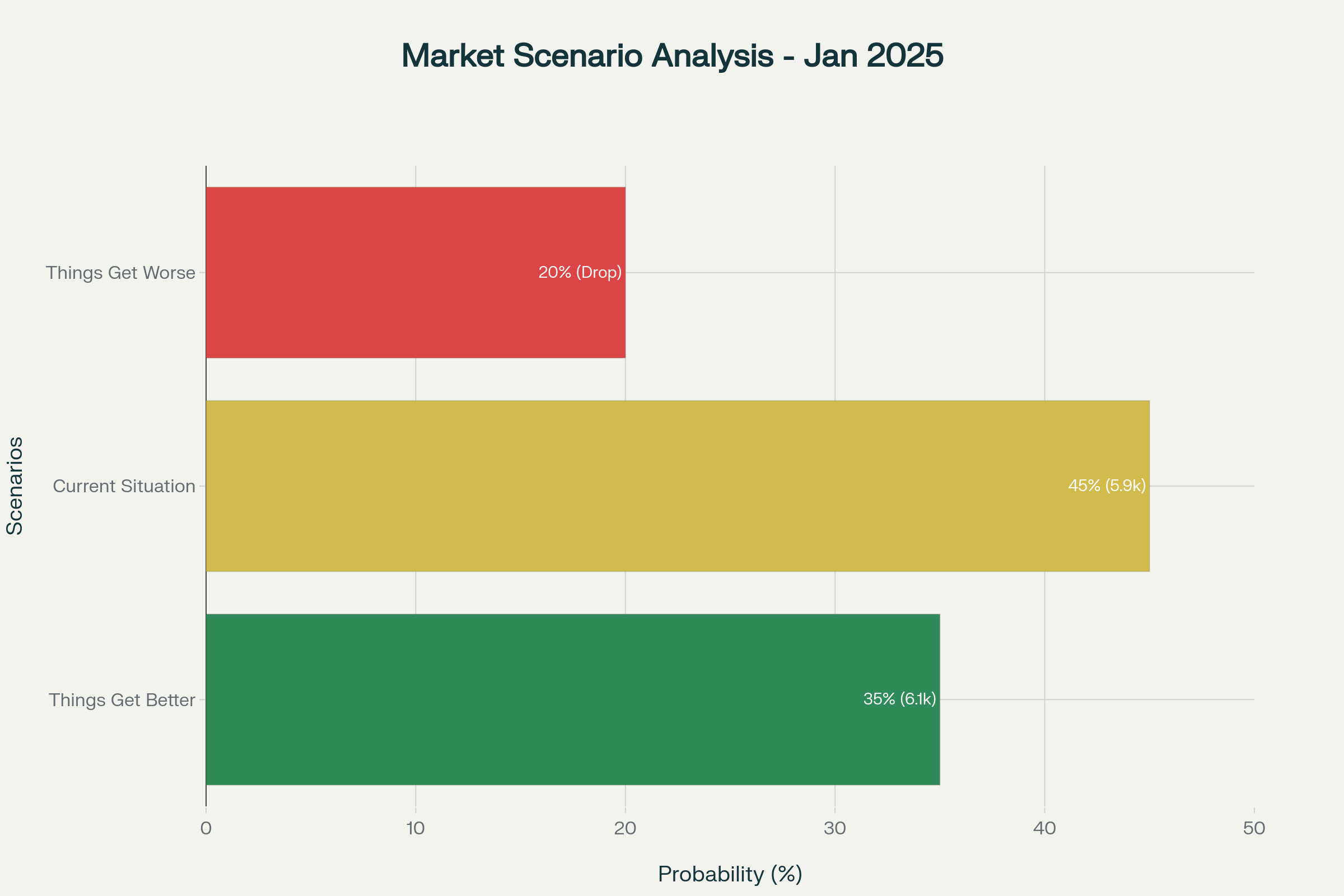

Donald Trump is now the 47th President of the United States and many investors are wondering how his policies will impact markets. So, our investment team wanted to identify the four key areas in Trump's policies that could impact markets, either positively or negatively. We are doing this because, now that Trump is President, the amount of news making comments, tweets, and "leaks" about potential policy decisions is likely to increase rapidly. To help cut through the noise, we highlight the four main areas Trump/Republican policies could impact the markets and what would make them broadly positive or negative for the economy/markets.

Area 1: Debt and Deficits

Given the relative legislative ease with which Trump can alter trade terms, we are likely to hear a lot about tariffs and trade right out of the gate, but that is not the biggest area of influence on the markets. Instead, the state of U.S. debt and deficits is, by far, the largest area of concern/interest for markets. If tax cuts are passed with no spending offsets, that will jeopardize the dollar's status as the reserve currency and the Treasury bond's "risk-free" perception, potentially leading to slower growth and higher rates. However, if concrete plans to slow government spending emerge, it could be a significant positive for markets.

Area 2: Tariffs

Tariffs are expected to be an immediate source of news and market volatility. If implemented incorrectly, they risk boosting inflation while hurting economic growth—a stagflationary scenario. The key will be in the details: the scope of the tariffs and whether popular consumer goods are excluded. Scary headlines are likely, but the market's reaction will ultimately depend on the specifics of the policies enacted.

Area 3: Taxes

The primary tax issue is the extension of the Tax Cuts and Jobs Act (TCJA). While widely expected, the timing is crucial. A delay that drags on throughout 2025 would create a significant headwind of uncertainty for stocks. A swift, early extension of the tax cuts would be a clear positive, removing ambiguity for businesses and investors.

Area 4: Immigration

From an economic standpoint, the U.S. economy relies on consistent immigration for labor. A sudden halt to this flow or mass deportations could disrupt the labor supply, leading to wage inflation and price increases for goods and services. The market will be watching for an approach that enforces laws without causing major economic disruption.

Economic Data (What You Need to Know in Plain English)

Markets started January nervous about a Fed pause and got some relief from cooler-than-feared CPI and PPI reports. Core PPI rose 3.3% and Core CPI increased 3.2% year-over-year, both slightly better than expected. While this calmed immediate fears, the pace of inflation's decline has slowed, and the data remains far from the Fed's 2.0% target. The question of a Fed pause remains open, meaning "hot" data will likely be a negative for markets while weaker data will be viewed positively.

Growth data, meanwhile, was almost universally solid. The key December retail sales report showed that discretionary consumer spending remains strong, with the "Control" group rising 0.7% versus an expected 0.4%. Overall, the economic data last month was nearly perfect for stocks: solid growth combined with moderating inflation, which understandably fueled a rally given the anxiety around Fed policy.

Special Reports and Editorial

Market Multiple Table (January Update)

The main change in our January Market Multiple Table is the re-ordering of market influences, with Fed rate cut expectations now taking the top spot. The market's recent declines have been driven primarily by concerns that the Fed may pause its rate-cutting cycle. This, combined with "too good" economic data and rising tariff threats, has pushed the 10-year Treasury yield to one-year highs, which is now weighing on stocks. Despite the recent pullback, our analysis suggests the market could fall further before reaching levels that are fundamentally justified.

Can Stocks Go Back-to-Back-to-Back?

After two consecutive years of 20%+ returns for the S&P 500, many investors believe the market is "due" for a bad year. However, history suggests otherwise. Going back to 1950, there were eight other times the S&P 500 delivered back-to-back 20% returns. In the year that followed, the index produced an average return of 12.3% and was positive six out of those eight times. While another 20-25% gain is not probable, history does not rule out another decent gain in 2025.

Hard Landing/Soft Landing Scoreboard

While policy and Fed uncertainty are driving short-term moves, the question of a hard vs. soft landing remains the most important long-term factor for markets. Positively, key economic data shows few signs of deterioration. In fact, underlying data has improved over the past month to the point where strong numbers are fueling fears of a Fed pause. Of the major indicators we track, only the ISM Manufacturing PMI is signaling a slight contraction, while services, consumer spending, business investment, and labor market indicators all point to a resilient economy. For now, the soft landing narrative remains intact.

Ready to Navigate These Markets Together?

Schedule your portfolio review to discuss how these market dynamics may impact your allocation strategy.

Schedule Your Review