Financial Market Insight | April 17, 2024

Financial Market Insight | April 17, 2024

HIGHLIGHTS

- Initial Thoughts on the Iranian Strikes on Israel

- Weekly Market Preview: How Bad Was Last Week for the Rally

- Special Reports and Editorial:

- The Most Important Long-Term Indicator for Markets

- What Does CPI Mean for Markets?

STOCKS

STOCKS

| SOURCE: Factset and Vann Equity Management Research Team |

“The S&P 500 declined last week as June rate cut expectations plunged following the hotter-than-expected CPI report and as Treasury yields surged to multi-month highs.”

- What’s Outperforming: Growth factors, tech, consumer discretionary and communication services have outperformed thanks to strong earnings and continued “AI” enthusiasm.

- What’s Underperforming: Defensive sectors and value have underperformed recently mostly as Treasury yields have risen, although they are poised to rebound substantially if there is a surprise slowing of growth.

Initial Thoughts on the Iranian Strikes on Israel?

Geopolitical tensions rose even further over the weekend as Iran launched several hundred missiles and drones at Israel, reflecting the biggest increase in tensions in the Middle East in decades. The immediate impact on markets would be as we would expect given rising geopolitical risks: Higher oil prices, lower stocks, higher risk-off assets (e.g., Treasuries). In the short term, the weekend’s events can be filed under the “Things We Do Not Need Right Now” category, as a market that has had a quasi-perfect environment for nearly five months must now contend with several disappointments including a hot CPI that pushes back on the idea of declining inflation, reduced Fed rate cut expectations from June to September (which means higher rates for longer) and a dramatic escalation in geopolitical tensions. That will increase volatility in the near term.

Bottom line: This is clearly a further deterioration in the geopolitical landscape, and it will increase market volatility. However, we would be hesitant to extrapolate this out to a bearish game-changing event. Yes, tensions remain high and the chances of a broader conflict in the region are present, but there remains a path to de-escalation.

How Bad Was Last Week for the Rally?

The S&P 500 dropped to a one-month low and experienced the strongest selling we have seen since the first two weeks of the year as inflation ran hot, markets abandoned the idea of a June rate cut and the two ongoing geopolitical crises (Russia/Ukraine and Israel/Gaza) threatened to escalate.

Looking at the events of last week, there were some clear negatives, and the market reaction was legitimate. First, CPI showed the decline in inflation, which had slowed to a crawl in recent months, fully stalled and that challenged the idea of falling inflation which has been one of the keys to this rally. Second, rate cut expectations for June were dramatically reduced and the first rate cut is now expected in September. That challenged the idea of looming rate cuts, which had also been one of the keys to this rally. Nevertheless, were these events material negatives that should make us suspect of this rally? No, not at this point.

As we have said, the key impact of the stall in declining inflation and delayed rate cuts is that it shattered the unrealistically optimistic view/valuation, but it did not change the medium-term outlook. Put in more regular terms, our investment team and others have called this a “Teflon” market, in that no bad news would “stick” and stop the rally. Well, last week, the hot CPI delayed Fed rate cuts and geopolitical tension “stuck” and stocks dropped accordingly.

Bottom line: The market was priced for perfection at 5,200 in the S&P 500 but it was forcefully reminded this week that the environment is not perfect, and stocks are declining accordingly. Given that sentiment and positioning were extended on the bullish side of the ledger, a continued decline towards 5,000 should not shock anyone.

Unless we see more bullish factors deteriorate (meaning growth underwhelms or AI enthusiasm begins to disappoint) or the Fed talks about hikes or inflation rebounds, then any decline towards (or through) 5,000 in the S&P 500 is likely an opportunity to add long exposure at more reasonable valuations.

Bottom line: Last week’s news was bad, but the four parts of this rally remain largely intact (solid growth, inflation declining, Fed cutting rates and AI enthusiasm) and it will take further deterioration to challenge the validity of the rally (although again, a further pullback near term should not surprise anyone).

Economic Data (What You Need to Know in Plain English)

Economic Data (What You Need to Know in Plain English)

Inflation for the month was the focus of economic data last week and the data sent a clear message that caused stocks and bonds to drop: The decline in inflation has stalled.

The key report was Wednesday’s CPI, and it came in hotter than expected as headline CPI rose 0.4% vs. (E) 0.3% m/m and 3.5% y/y (up from 3.2%). More importantly, Core CPI rose 0.4% vs. (E) 0.3% and 3.8% vs. (E) 3.7%. The market impact was immediate as the S&P 500 and Treasury bonds both fell sharply. The biggest practical impact of the hot CPI report was the drastically reduced June rate cut chances, which ended the week at just 25% (down from 65% pre-CPI).

Bottom line: Markets need inflation to continue to decline to fuel a further rally and inflation stats will remain in sharp focus over the coming weeks.

COMMODITIES, CURRENCIES & BONDS

COMMODITIES, CURRENCIES & BONDS

“Commodities were little changed last week as volatile geopolitics were offset by disappointing Chinese economic data, with geopolitical risks elevated, commodities should remain generally supported.”

| SOURCE: Factset and Vann Equity Management Research Team |

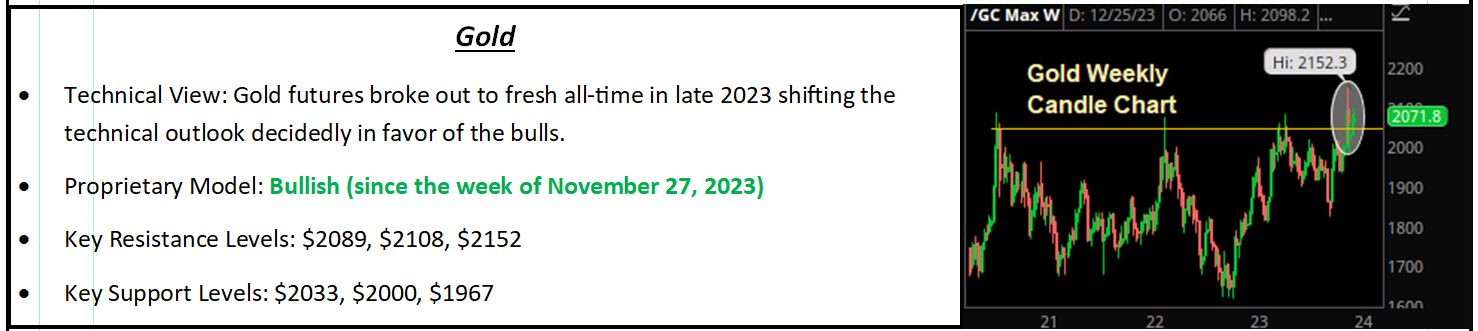

Commodities were mixed and price action was volatile last week as geopolitical headlines saw oil whipsaw between gains and losses before ending the week lower while inflation worries powered gold to new records and copper continued to rally on expectations for a bullish supply-demand imbalance in 2024.

The acts of war by Iran, an OPEC member and major global oil producer, bring the geopolitical seriousness of the conflict/emerging war to the next level and should send oil prices meaningfully higher near term as traders assess the developments overseas and the impact they will have on oil supply and demand dynamics.

SPECIAL REPORTS AND EDITORIAL

SPECIAL REPORTS AND EDITORIAL

The Most Important Long-Term Indicator for Markets

What is the single most important long-term indicator in the markets right now? The unemployment rate.

Throughout late 2023 and so far in 2024, our investment team has maintained that the one “rally killer” event we all need to be watching for is an economic slowdown. First, a slowdown is nowhere near priced into markets and the resulting price correction if we get a slowdown could easily be 5 or 6 market multiple points. So, the market multiple is going from the current 21X to something like 15X-16X. Given that 2025 earnings are around $240/share, that means a market decline of 1200-1400 points is not unreasonable in the S&P 500. That would put the S&P 500 under 4,000.

Bottom line: Markets will get more volatile.

They have to, as the past five months are not typical market behavior, and it will not last forever. However, volatility does not mean an end to the rally and understanding the difference is very important (and it is something we are going to make sure we tell you).

What Does CPI Mean for Markets?

CPI ran hotter than expected and resulted in a moderate decline in stocks as expectations for a June rate cut fell to just about 20% and markets priced in just two rate cuts for 2024, undermining one of the four main factors of the 2024 rally (looming rate cuts).

There were a lot of conflicting headlines in markets about what this hot CPI means, so I wanted to cover its likely impact on the market in the short and medium term.

First, CPI did not imply inflation was rebounding. Reports that imply inflation is bouncing back are exaggerating the impact. The bounce in headline CPI was caused by volatile and likely overstated factors, and it was largely expected. Core CPI did not decline, but it also did not rebound, and the 0.4% monthly increase was just 0.359% if taken out an extra decimal place. The point is that core CPI was nine-thousandths away from meeting expectations. The decline in inflation has stalled, but inflation is not bouncing back.

Bottom line: The keys are growth and earnings. If Q2 earnings are strong and economic growth remains stable, then the S&P 500 can move higher despite elevated Treasury yields and no Fed rate cuts.

Disclaimer: The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.