Financial Market Insight | July 2024

Financial Market Insight | July 2024

HIGHLIGHTS

- Market Impact of the Assassination Attempt on Former President Trump

- Acknowledging There is a Downside to Current Market Events, Too

- Weekly Market Preview: Do Growth and Earnings Hold Up?

- Weekly Economic Cheat Sheet: An Important Check on the Consumer This Week

- Special Reports and Editorial:

- Is the Rotation from Tech to the “Rest of the Market” Sustainable?

- Powell Testimony Takeaways

- Market Multiple Table: An Important Change

STOCKS

STOCKS

| SOURCE: Factset and Vann Equity Management Research Team |

“The S&P 500 hit yet another record high last week as CPI rose less than expected and boosted investor expectations for a September rate cut and two rate cuts in 2024.”

- What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively outperformed recently as markets have become more volatile.

- What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

Market Impact of the Trump Assassination Attempt

Former President Trump survived an assassination attempt by an apparent lone gunman over the weekend. While obviously a troubling event regardless of political affiliation or preference, the market impact of it should be relatively limited because the market already assumes a Trump victory, and potential Republican sweep and the events of the weekend do not reduce those chances, and potentially increase them.

The S&P 500 hit yet another new high last week (the 36th of 2024!) as stocks continued to ride a wave of optimism surrounding three main events:

1) Impending Fed rate cuts,

2) Continued disinflation (decline in inflation), and

3) Expectations for a Republican sweep in the November election.

The “good” scenario of each of those events has been instrumental in sending the S&P 500 through 5,600. First, the Fed rate cuts will reduce pressure on the economy, likely reducing the chances of a hard landing. Second, disinflation will ease the “inflation tax” being paid by consumers, helping to make consumer spending (which is a critical part of the economy) more resilient. Finally, if Republicans sweep, the Trump tax cuts will be extended, and a more pro-business regime will take total power.

All of those outcomes are positive and expectations of them have rightly pushed stocks higher. However, there are negative outcomes from these events, and while we are not going to say they are likely, it would be a mistake for investors to simply assume there is no potential drawback to these events because there is a negative consequence for each of these that we must consider.

Reviewing these same points as above, fed rate cuts will reduce the headwind on the economy, but it is the “why” that matters. Is the Fed cutting rates because growth is slowing more than they anticipated? Slowing growth can be a major negative for markets and despite investor enthusiasm, rate cuts are not a guaranteed market positive event.

Second, disinflation does reduce headwinds on consumer spending; however, it can also reduce corporate earnings! The pandemic inflation has been a blessing to S&P 500 earnings, as consumers simply digested the price increases, boosting both revenue and margins across industries! However, inflation is now falling because 1) Supply chains have normalized and 2) Because the consumer is pulling back (less demand). Falling prices can compress margins and reduce revenue and we have seen evidence of that occurring across earnings recently (NKE and WBA a few weeks ago, DAL/CAG/PEP last week). Disinflation is a macroeconomic good, but it can also place downward pressure on earnings, which would be a negative for stock prices.

| The Good and Bad of Current Market Drivers | |||

| Market Driver | Good Scenario | Bad Scenario | |

| Fed Rate Cuts | Eases headwind on economy, ensures soft landing. | Cuts occur because growth is slowing. September cut not enough to stop larger-than-expected slowdown. | |

| Falling Inflation | Eases cash crunch on consumers, allows Fed to cut rates. | Pressures corporate margins and revenues and S&P 500 earnings don’t grow to $270 in 2025. | |

| Republican Sweep in November | Keeps taxes low, ushers in pro-business environment, which is good for earnings. | Tariffs and trade wars ensue, no deficit relief spikes Treasury yields (creates economic headwind). | |

Bottom line: Clearly the momentum in markets is higher and this is, currently, a Goldilocks environment for stocks. Yet the market continues to reek of complacency regarding some very substantial changes in macroeconomic forces compared to the past several years, and while our investment team sincerely hopes they all work out positively, we must acknowledge the downside of these events as well, because we will not get blindsided (as some advisors and investors will be) should one (or more) of these events not be as positive as currently expected.

Economic Data (What You Need to Know in Plain English)

Economic Data (What You Need to Know in Plain English)

CPI was the key report so far this month and it beat expectations, further signaling disinflation is ongoing and, most importantly, likely solidified the Fed will cut rates in September and kick off a rate cutting campaign.

The focus will turn to growth this week and while none of the data is from the major monthly reports, all growth data matters (especially given the Fed is about to start cutting rates) so that we can learn, as early as possible, if rate cuts will be enough to prevent a stall or contraction in the economy. Put simply, the chorus of economic data that has been pointing to a loss of momentum has grown louder over the past month and if that continues, growth concerns will creep higher.

The most important economic report this week is Wednesday’s June Retail Sales. The U.S. economy is a consumer-driven economy and put simply, if the consumer pulls back, the chances of a hard landing will rise. Retail spending has been, at best, plateauing lately and if that plateau turns into an outright decline or contraction, it will be an incremental negative for markets.

COMMODITIES, CURRENCIES & BONDS

COMMODITIES, CURRENCIES & BONDS

“Commodities declined modestly last week despite a weaker U.S. Dollar, as global growth worries weighed on oil while gold saw a modest rally thanks to the lower dollar.”

| SOURCE: Factset and Vann Equity Management Research Team |

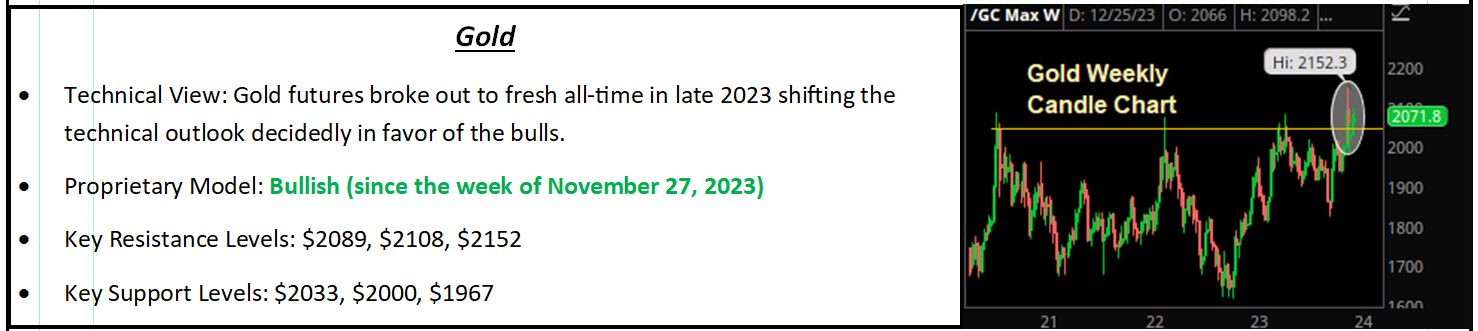

Gold was little changed through the front half of the week before lurching towards record highs on Thursday thanks to the cool June CPI data and the resulting combination of firming Fed rate cut expectations for the months ahead and rising confidence in the economy achieving a soft economic landing this year.

SPECIAL REPORTS AND EDITORIAL

SPECIAL REPORTS AND EDITORIAL

Is the Rotation from Tech to the “Rest of the Market” Sustainable?

By far the biggest impact of last week’s CPI report was the massive rotation out of tech and tech-related sectors (tech, consumer discretionary, communication services) and into sectors that are 1) More sensitive to lower rates and 2) Cyclical in nature. This is best exemplified by the fact that the Russell 2000 surged almost 3.6% Thursday while the Nasdaq 100 dropped 2%, resulting in a massive 6% swing in their relative performance. But even considering that massive 6% swing, the Nasdaq is still outperforming the Russell 2000 by 15% YTD and that just underscores how badly cyclical and lower-rate-sensitive sectors have performed compared to AI-driven tech.

Market Multiple Table: An Important Change

For much of 2024, the S&P 500 has been trading solidly above any fundamental justified valuations, as a combination of rate cut hopes and AI earnings pushed the S&P 500 to the very limits of forward valuations. But the “market multiple” math just got a bit easier for the bulls, because around July of each year, analysts switch their earnings expectations from the current year to the next year, and in doing so the July Market Multiple Table now shows this market, at these levels, is reasonably valued as long as 2025 earnings estimates are correct!

Disclaimer: The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.