Here’s the Average Social Security Benefit at Age 70

Story by Sean Williams

For most Americans, Social Security provides an indispensable source of income. In addition to lifting more than 21.7 million people out of poverty every year — roughly 15.4 million of whom are adults aged 65 and over — it’s a program that nearly 9 out of 10 retirees count on, in some capacity, to make ends meet. Given Social Security’s importance to the financial well-being of current retirees, getting the most you can out of the program is paramount. This begins with understanding how your Social Security benefit is calculated and how your claiming age — including potentially waiting until age 70 — can drastically impact what you’ll receive on a monthly and lifetime basis.

These four elements are what determine your monthly Social Security check

When examined broadly, there are a number of factors that can impact how much of your Social Security benefit you’ll get to keep. The potential taxation of benefits at the federal level and in 12 states, along with penalties applied to certain early filers, are examples of ways your take-home benefit can be reduced. But when broken down to the basics, there are just four elements that are used to calculate your monthly Social Security check:

- Work history

- Earnings history

- Full retirement age

- Claiming age

The first two factors, work history and earnings history, provide a relatively straightforward correlation to Social Security benefits. The Social Security Administration (SSA) takes your 35 highest-earning, inflation-adjusted years into account when calculating your monthly payout. If you earn more during the 35 years taken into consideration, you’ll receive a larger Social Security check during retirement.

The caveat to the above is that you’ll want to work at least 35 years, if not more. For every year less of 35 worked, the SSA will average a $0 into your calculation, which can seriously hurt your chances of maximizing your payout.

The third element is your full retirement age, which is determined by your birth year and represents the age you become eligible to receive 100% of your retied-worker benefit. Age 67 is the full retirement age for anyone born in 1960 or later.

The caveat to the above is that you’ll want to work at least 35 years, if not more. For every year less of 35 worked, the SSA will average a $0 into your calculation, which can seriously hurt your chances of maximizing your payout.

The fourth factor that determines how much you’ll be paid each month from Social Security is your claiming age. It’s the element that can have the biggest impact on what you’ll receive each month, as well as during your lifetime.

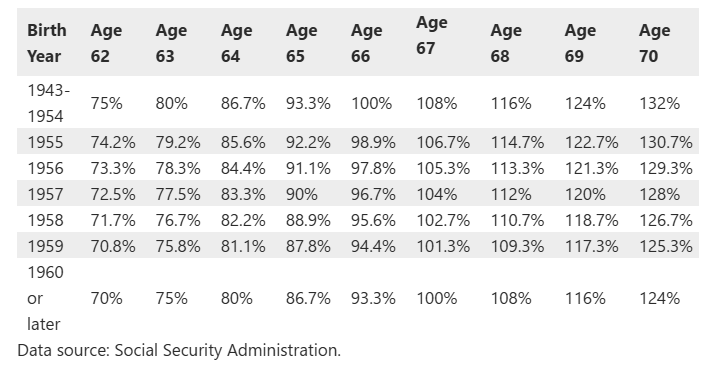

Although benefits can be claimed as early as age 62, Social Security undeniably incents patience from retirees. For every year a retired worker stays on the sideline and waits to take their benefit, beginning at age 62 and continuing through age 69, their monthly check can grow by as much as 8%, as shown in the table below.

What’s the average Social Security benefit at age 70

As you’ll note from the payout schedule above, there are sizable differences in monthly payouts depending on how long a worker is willing to wait.

For instance, future generations of retirees who choose to take their benefit at the earliest eligible age (62) will see their monthly Social Security check reduced by up to 30%. Waiting five extra years, to age 67, will net them 100% of the monthly payout they’re due. But holding out for eight full years, post-eligibility, to age 70, can increase future retirees’ monthly checks by 24% above and beyond what they’d have received at full retirement age.

Just how big of a payout are beneficiaries at age 70 taking home? Based on data from the SSA in December 2022, the 2,955,215 retired workers receiving benefits at age 70 were bringing home $1,963.48 for the month, or about $23,562 on an annual run-rate basis. For context, the average monthly benefit at age 70 is about 6% higher than the average monthly check for aged 67 beneficiaries and a whopping 54% higher than the $1,274.87 aged 62 beneficiaries are taking home per month.

Even though age 70 was one of the least popular claiming ages in 2022 — it ranked seventh out of nine possible claiming ages from 62 to 70 — it’s been slowly growing in popularity in recent decades. This is a trend that may continue due to increased longevity.

When Social Security began doling out retired-worker benefits in January 1940, the average life expectancy in the U.S. was approximately 63 years. Today’s life expectancy at birth in the U.S. has surpassed 76 years. With people living considerably longer, it’s not a surprise to see eligible retirees holding off for a larger monthly check.

The interesting thing about an age 70 claim is that, statistically, it may make sense for a majority of retirees.

This relatively unpopular claiming age is, statistically, a smart choice for most retirees

To be completely fair and upfront, there isn’t a concrete blueprint that tells eligible retirees ahead of time what age would be best to take their benefit.

For instance, people in poor health are unlikely to wait eight full years (i.e., to age 70) to maximize their monthly benefit. Though an early filing can lead to a permanently reduced monthly payout, it may also be a means to maximize lifetime benefits — and optimizing what you’ll receive over your lifetime is what truly matters.

In 2019, online financial planning company United Income released a study that analyzed the Social Security claims of roughly 20,000 retired workers using data from the University of Michigan’s Health and Retirement Study. The goal for researchers at United Income was to determine if these claimants made “optimal” decisions that produced the highest possible lifetime income.

What United Income found was that actual Social Security claims and extrapolated optimal claims were a near-perfect inverse of each other. While most retirees chose to take their payout prior to reaching full retirement age, United Income found that waiting consistently yielded the highest lifetime benefits for retirees. Even though age 70 ranks well behind most other claiming ages in popularity, it would have been the optimal claiming age for 57% of the 20,000 claimants studied.

All told, around 4 out of 5 retirees would have made an optimal decision by taking their payout at or after age 67. Meanwhile, just 8% of retirees made the smartest choice claiming their benefit at ages 62, 63, and 64, combined!

Although everyone’s financial, marital, and health circumstances will be unique, waiting to claim Social Security benefits is, statistically, going to be a smart decision for most future retirees.

Disclosure: The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The information herein should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Additional tax rules not discussed herein may also be applicable to your situation. This material should not be regarded as a research report. Forward-looking statements should not be considered as guarantees or predictions of future events.

Past performance is no guarantee of future results. Any views or strategies discussed in this material may not be appropriate for all individuals and are subject to risks. All investments are subject to risk, including the possible loss of the money you invest.

The data and information set forth in this presentation has been compiled and prepared from sources we believe to be reliable, however, we make no representations, warranties or guarantees as to its accuracy or completeness, nor has it been reviewed, approved or verified by the Securities and Exchange Commission or any state securities regulatory agency. However, its accuracy, completeness or reliability cannot be guaranteed. The information contained herein is not to be construed as a solicitation or an offer to buy or sell any securities, or related financial instruments Vann Equity Management disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources.