Financial Market Insight | September 2024

Financial Market Insight | September 2024

HIGHLIGHTS

- How to Explain This Market (September Update)

- Weekly Market Preview: Two Key Central Bank Decisions (Fed on Wednesday, BOJ on Thursday)

- Weekly Economic Cheat Sheet: Important Growth Updates This Week

STOCKS

STOCKS

| SOURCE: Factset and Vann Equity Management Research Team |

“Stocks rallied and the S&P 500 climbed close to previous all-time highs thanks to solid tech earnings from ORCL and increased expectations for a 50-bps rate cut from the Fed”

- What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively outperformed recently as markets have become more volatile.

- What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

How to Explain This Market

Over the weekend our investment team spoke to several investors who were in somewhat of disbelief that stocks remained so resilient in the face of political uncertainty and, what is to them a slowing economy; and in those discussions, we pushed back on some of their negative expectations, and it was very well received, so we wanted to share our points with you below.

First, and importantly, the burden of proof remains with the bears. Put simply, the news is not bad enough yet to cause a sustainable decline in stocks. Yes, there are anecdotal economic and earnings warning signs including the rising unemployment rate, the very weak ISM Manufacturing PMI1, negative bank guidance, and an uncertain retail environment. Yes, there are negative macro risks out there: Political uncertainty (Harris or Trump?), economic uncertainty (soft or hard landing), and geopolitical turmoil (Russia/Ukraine, Israel/Hamas, Taiwan). However, those potential risks and anecdotal negatives, while all legitimate, are not yet enough to distract investors from positive factors in this market.

Those positive factors are:

1) Still generally “ok” economic data (yes, it is clearly slowing, but as of right now it is still “ok”).

2) Looming Fed rate cuts (investors often ignore the reality that Fed rate cuts do not always extend market rallies, so they initially welcome cuts as a bullish positive).

3) Expected earnings growth (still more than 10% y/y).

4) AI enthusiasm (it has been reduced but is still alive as last week’s price action showed us).

Second, while a “Wall of Worry” still exists, stocks remain resilient. Those risks of uncertainty we just laid out in our first point (Political, Geopolitical, and Economic) are negatives that could indeed happen (and if they do, they would be bearish game changers); but right now, they are not happening. So, as data points and news fail to reinforce those concerns, we are seeing stocks grind higher.

Third, that leaves a market dynamic where the S&P 500 could easily hit a new high this month. If economic data this week does not confirm growth fears and the Fed cuts 50 bps (or cut a of 25 bps and promises of further aggressive rate cuts) we should not be shocked if the S&P 500 moves to a new, all-time high. However, new highs this week would not mean this market is not still facing serious risks. While the S&P 500 can grind higher in the short term, the reality is that 1) Growth is slowing, 2) Rates are falling, 3) Earnings growth is facing headwinds and 4) Political and geopolitical risks remain high.

The combination of these looming risks and the very elevated valuations make this market very exposed to 1) Dramatic negative shocks that could cause a sharp “air pocket” in stocks similar (or worse) to what we saw in early August and 2) A growth scare that would easily open up a 10%-20% sustainable and long-lasting decline in stocks.

Bottom line: The risks currently facing this market (economic growth, earnings, geopolitics) are tectonic risks. They do not present themselves all at once or in a flash, they evolve over time until they become sustainable and that is when bear markets occur. This market is facing those risks but facing them does NOT mean they will happen. That is why our investment team believes the right way to navigate this market is that we closely monitor these risks, while not prematurely abandoning the long side. Our team has advocated this management strategy throughout 2024, and it has been working, and it is what we continue to believe is the right way to successfully navigate this current market. If and when the facts change, our outlook will change and you will hear it first, loudly and clearly.

Economic Data (What You Need to Know in Plain English)

Economic Data (What You Need to Know in Plain English)

Inflation was the focus of last week’s data, and the message was remarkably consistent: The decline in inflation slowed, not to the point where it would be a problem for markets or the economy, but it could push back on any Fed member’s desire to very aggressively cut rates (they are still going to cut this week, but maybe not as much as before).

The key inflation report was CPI, and it was firmer than expected. Headline CPI dropped sharply to 2.5% y/y (down from 2.9%) but most of that drop was energy-related (lower oil prices). The more important Core CPI was flat vs. July, rising 3.2% y/y. The monthly increase was a touch high, rising 0.3% vs. (E) 0.2%. These inflation numbers are not bad in the broad sense, and they do not imply inflation is bouncing back (it is not) but for those hoping for very aggressive rate cuts.

1 ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at manufacturing firms nationwide. It is considered to be a key indicator of the state of the U.S. economy.

COMMODITIES, CURRENCIES & BONDS

COMMODITIES, CURRENCIES & BONDS

“Commodities were mixed to start last week as demand fears persisted in the wake of several weak industry reports. However, dovish bets for a 50-bps cut from the Fed this week rekindled soft landing hopes and shored-up demand expectations, driving the complex higher into the weekend with metals and energy all notching weekly gains”

| SOURCE: Factset and Vann Equity Management Research Team |

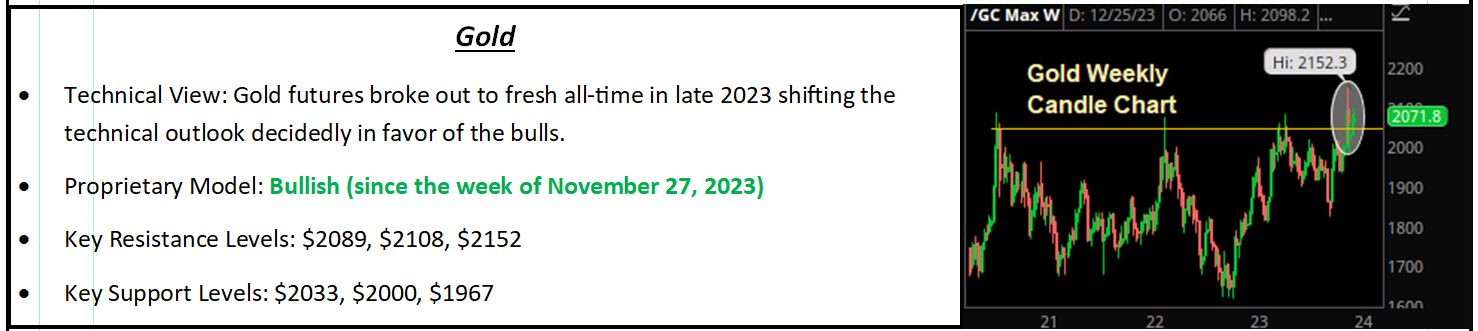

The outlook for oil remains bearish despite a mid-September relief rally beginning last week. Fundamentals are pointing to an increased likely surplus emerging in the physical markets in the months or quarters ahead and recession fears continue to simmer despite a resurgence in soft-landing hopes. On the charts, last week’s low close of $66.31 will be looked to for initial support while previous support at $72.50 will present initial resistance.

Disclaimer: The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.