Financial Market Insight | May 2024

HIGHLIGHTS

- When Does Bad Economic Data Become Bad for Stocks?

- Weekly Market Preview: An Important Week: Fed Decision (Including the Dots), CPI and AI Updates.

- Do We See Real Movement in Rate Cut Expectations?

- Special Reports and Editorial:

- What Is the Smart Market Telling Us?

STOCKS

SOURCE: Factset and Vann Equity Management Research Team

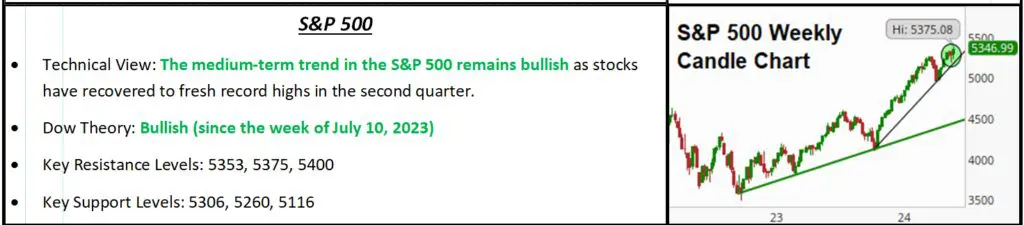

“The S&P 500 hit a new all-time high last week thanks to more AI enthusiasm and mostly Goldilocks economic data.”

What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively outperformed recently as markets have become more volatile.

What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

When Does Bad Economic News Become Bad For Markets?

Markets have been volatile to start the month thanks to conflicting economic data, as initially soft data increased rate cut expectations, and that, combined with surging AI enthusiasm, pushed the S&P 500 to new all-time highs. However, those gains were partially reversed as strong economic data (ISM Services and the jobs report) pushed back on rate cut expectations.

For now, bad economic data remains good for stocks and bonds while good economic data is a negative for stocks and bonds, again because markets are trading off shifting rate cut expectations. But before Thursday’s solid ISM Services PMI, there was some chatter in markets that bad economic data might start to be bad for markets. That did not happen last week, but it begs an important question: When will bad economic data become a negative for stocks?

The answer is: Bad economic data will become negative for stocks when the data is so bad that it sparks legitimate growth worries. To be clear, that did NOT happen last week (it may have happened if Thursday’s ISM Services PMI and jobs report were soft). Nevertheless, it is important to realize that while data is not at that point yet, it is moving in that direction and as a result, slowing growth remains the biggest risk to this market (and it is not as insignificant a risk as the new highs in stocks imply).

Reasonably, one might think, “If growth risks are building, why are stocks at new highs?” There are two reasons for this:

First, AI. AI mania continues unabated, and the truth is that generic product updates from AI-focused companies (the next one is AAPL this week) still are effective at pushing the tech sector and the entire S&P 500 higher.

Second, rate cut expectations. The market is still primarily driven by Fed rate expectations and if rate cut expectations increase (as they did last week) that more than offsets any concerns about growth. Until those factors are eliminated (by AI hype finally getting overdone or data turning decidedly worse) stocks can rally despite the totality of economic data pointing towards a slowing of growth.

Because our focus is beyond the short term, our investment team continues to believe that maintaining long exposure while also actively trying to reduce volatility in portfolios remains appropriate and that continues to be best done via defensive sectors, quality factors and lower-volatility styles.

We are looking forward to the Fed and the CPI print, which will be in focus and lower yields will equal higher stocks. However again, amidst that potential enthusiasm, the outlook for growth is deteriorating and we will continue to point out that reality.