Financial Market Insight | July 2024

HIGHLIGHTS

- The Growth Scare Is Here (What It Means for Markets)

- Weekly Market Preview: How Far Can This Pullback Go?

- Weekly Economic Cheat Sheet: Important Growth Report Today

- What the Fed Decision Means

The week of August 5, 2024, begins with a major global market sell-off following the Bank of Japan’s decision to tighten monetary policy for the first time in three decades. As investors brace for the volatility tsunami impacting a cross-section of risky assets (stocks, credit, commodities), greater uneasiness and a slowing U.S. economy could be enough to prompt the Federal Reserve to adopt a more aggressive schedule for cutting interest rates and loosening monetary policy. As such, we as investors may be given a narrow window to add on market risk if financial contagion does not spread or does the global economy fall into recession.

The interconnectedness of global financial markets means that Japan’s financial turmoil could have ripple effects worldwide and exacerbate tightening financial conditions that would impact the funding sources of risk-on position-taking. The sell-off is not only impacting global equities, particularly markets with high-yielding currencies funded in the so-called carry trade. A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return. A carry trade is typically based on borrowing in a low-interest rate currency and converting the borrowed amount into another currency such as Australia, New Zealand, and Latin America, but also

corporate credit risk and commodities.

Despite the recent pullback and selling pressures, the analyst community remains sanguine over earnings prospects, not just for U.S. companies, but for global markets as well. Earnings are expected to grow over the next two years for the major markets (U.S., Japan, Europe, and Emerging Markets) even if that growth trajectory starts to slow down. Near-term liquidity-driven selling could eventually give way to long-term earnings growth reality.

![]() STOCKS

STOCKS

SOURCE: Factset and Vann Equity Management Research Team

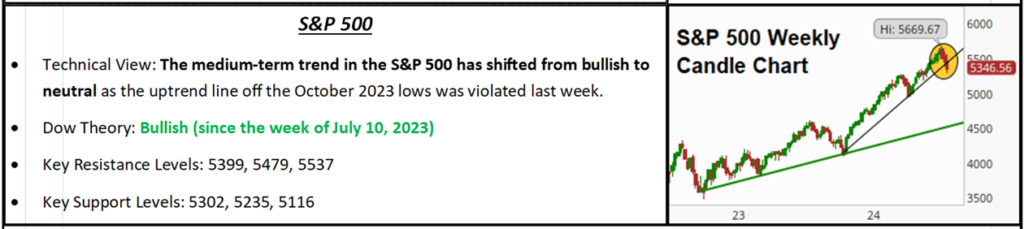

“The S&P 500 fell sharply last week thanks to disappointing economic data as the economic growth scare finally arrived and pushed the S&P 500 to multi-week lows.”

✓ What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively

outperformed recently as markets have become more volatile.

✓ What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.