Financial Market Insight | March 2024

HIGHLIGHTS

- Market Preview: Updated Risk/Reward Outlook

- Economic Update: What you need to know in plain English.

- Special Reports:

- What Is the Bitcoin ‘Halving?’

- What the Fed Decision Means for Markets: Still All About Growth

STOCKS

STOCKS

SOURCE: Factset and Vann Equity Management Research Team

“The S&P 500 accelerated to new all-time highs thanks to the Fed upgrading its outlook for economic growth this year (and inflation expectations) while critically keeping three rate cuts penciled in for 2024,

which reignited soft/no landing hopes in the back half of the week.”

- What’s Outperforming: Growth factors, including tech and communication services have outperformed thanks to strong earnings and continued “AI” enthusiasm while energy and financials have both had solid runs into the end of the quarter.

- What’s Underperforming: Defensive sectors, including real estate and utilities as well as value styles have underperformed recently as Treasury yields have risen, although they are poised to rebound substantially if growth slows down.

This month the stock market rallied to new record highs as the Fed (FOMC) maintained its expectation for three rate cuts this year while simultaneously upgrading its outlook for domestic economic growth. The uptick in inflation expectations was largely dismissed because, as long as, growth holds up, “slightly sticky” high inflation will be tolerated.

However, growth is the key variable as an economic slowdown is not at all priced into the market with the S&P 500 trading above 5,200 at a never-before-sustained next, 12-month multiple of 21.5X expected current-year earnings.

To be sure, history has proven on multiple occasions that markets can remain irrational longer than even the most seasoned investors can remain solvent, which is why it would be a fool’s errand to try to short this market based on fundamental caution right now. There is simply too much bullish momentum behind the advance. To that point, the bullish fundamental mantra for 2024 is still intact based on the expectations for:

- imminent rate cuts this year,

- continued disinflation,

- resilient growth, and

- ongoing AI optimism.

All that is great, and we are hopeful this rally can continue to new highs.

Playing devil’s advocate, using the round number of 10% to perform a quick risk-reward assessment of the market, the S&P 500 is up nearly 10% YTD; and another 10% gain from here would take the S&P 500 to just shy of 5,800. This would mean an extremely stretched multiple of 23.8X this year’s expected earnings. Conversely, a 10% pullback from here would take the S&P 500 down towards 4,735, which would mean a much more reasonable multiple of 19.5X this year’s earnings and match the “Current Situation” midpoint price target from the March Market Multiple updates.

So, if everything remains perfectly “Goldilocks” between economic growth, inflation, earnings, and Fed policy, there is a case to be made for that next 10% to the upside. However, the number of risks to the overextended rally leaves our investment team a bit skeptical about meaningful further upside and cautious (not bearish) about the YTD gains as one negative catalyst (i.e. a hot inflation print or weak growth report) could spark volatility and a pullback in stocks, which would likely be amplified by the combination of an increased amount of leverage in the long mega-cap tech trade, and a historically overcrowded short-volatility position.

Economic Data (What You Need to Know in Plain English)

Economic Data (What You Need to Know in Plain English)

This month the market’s focus was on the March Fed meeting, which proved to be a bullish catalyst for markets. Economic data was mixed, as several reports met the perfect “Goldilocks” criteria needed for a soft landing, while others were a bit less encouraging.

Chairman Powell and the company did not disappoint with their Summary of Economic Projections which revealed an upgraded outlook for growth and still mentioned three rate cuts anticipated for this year, which overshadowed a modest increase in their inflation expectations for 2024. Powell confidently proceeded through the Q&A session and there were no surprises, statements or comments that discounted the dovish-leaning outcome of the FOMC meeting. That saw stocks sprint to record highs amid firming confidence in the prospects of a soft landing in 2024.

No material moves in the weekly jobless claims data and a strong Philadelphia Fed Business Outlook Survey provided very optimistic forward-looking indicators and evidence of easing price pressures, as well as, improving corporate margins. Those reports followed modestly soft Composite PMI Flash releases in Europe, which were received as slightly dovish.

Bottom line: There were a few less-favorable reports sprinkled into the economic data this month, but for the most part, the widely followed economic releases supported the idea that the Fed is on track to cut rates multiple times between now and the end of the year with an initial cut still being priced in for some time in the summer. Any data that challenges that thesis, such as hot inflation or very strong growth will present a risk to the 2024 rally.

COMMODITIES, CURRENCIES & BONDS

COMMODITIES, CURRENCIES & BONDS

SOURCE: Factset and Vann Equity Management Research Team

“Commodities traded with a bias to the downside last week with copper the notable laggard with a 3% pullback after previously breaking out to YTD highs. Gold edged higher on dovish money flows while oil retreated from a test of $83/barrel, but the space remains in a long-term uptrend.“

Commodities were volatile: Copper extended its 2024 rally early in the week during solid Chinese economic data as Retail Sales and Industrial Output figures both topped estimates. On the charts, the outlook for copper is still bullish after the breakout through resistance earlier in March, and last week’s 3%+ pullback should be viewed as a countertrend pullback in an up-trending market.

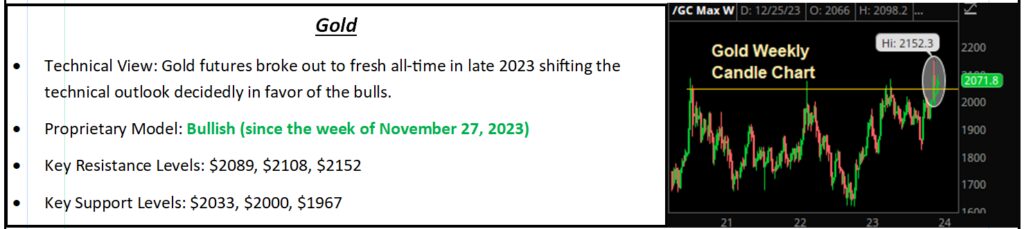

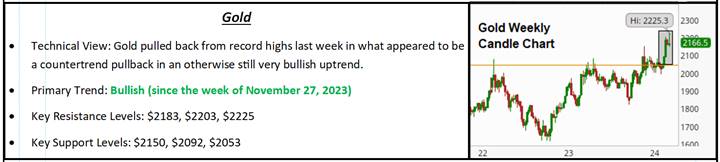

Gold has been trading in a broad range of more than $75/oz. as futures closed at a new high in the wake of the dovish Fed. The reason for the new high close was a spike in market-based inflation expectations to the highest in more than four months, and that sent futures to new highs before the less-favorable economic data (Composite PMI Flash and Existing Home Sales) sent the dollar to six-week highs, which poured cold water on the gold rally.

WTI crude oil advanced into technical resistance above $83/barrel ahead of the EIA report and Fed. The EIA data was mostly bullish but not enough to prevent a profit-taking pullback that carried the price down towards $80/barrel.

Bottom line: oil remains in a 2024 uptrend with a solid support band lying between $78 and $79/barrel while the YTD high of $83/barrel is the level to beat for the bulls.

“The Dollar Index rallied solidly as the Fed was dovish, but not as dovish as other global central banks. That dynamic paired with still-stronger economic data in the U.S. vs. other major developed countries supported a weekly gain in the greenback.”

Dollar strength was the theme in currency markets as the greenback initially pulled back from a test of the March highs after the Fed was initially received as dovish.

The outlook for the dollar remains universally bullish as we approach the end of the first quarter with the U.S. economy holding up as the most resilient, while cracks in growth overseas and faster-than-expected disinflation trends in other major developed economies are weighing on most of the G7 currencies.

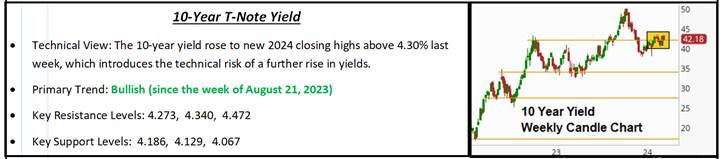

The Treasury market reaction to the Fed decision and last week’s economic data was largely dovish and that is an encouraging sign for stocks near term, as it is not just equity investors but also bond traders buying into the idea that the Fed will be able to achieve a soft landing with multiple rate cuts in the second half of the year.

SPECIAL REPORTS FOR ADVANCED RENDERS

SPECIAL REPORTS FOR ADVANCED RENDERS

What Is the Bitcoin ‘Halving?’

Our investment committee does not focus a lot on Bitcoin for numerous reasons, primarily because it has been largely an un-investable asset class for most clients (either practically or from a risk management standpoint). However, the approval of the Bitcoin ETFs has changed that, and as such, we will be modestly increasing our Bitcoin analysis in our Vann Equity Market Insight, as it is simply a very popular topic among investors. To be clear, please do not take this as an endorsement or opinion on Bitcoin, it is just our team reacting to the changing investing landscape and wanting to make sure our clients have the analysis. Appropriately, a popular Bitcoin-related topic: “The halving.”

Bitcoin’s “anonymous” creator, Satoshi Nakamoto, wanted Bitcoin to stand out from all paper currencies (i.e., dollar, euro, franc, etc.). Nakamoto wanted Bitcoin to hold its (or gain in) value over time, so he built an “anti-inflationary mechanism” into its code.

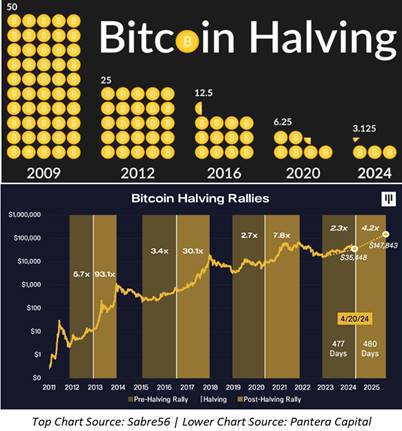

Per its code, the “block subsidy is cut in half every 210,000 blocks, which will occur every four years.” Therefore, every four years, there is a 50% reduction in the number of new Bitcoins that come to market. This continuous four-year cycle – built into Bitcoin’s code – is fixed and cannot be altered. This is what is known as “the halving” (also called “the halvening”).

The 2024 halving will reduce the number of new Bitcoins mined (the “block reward”) from 6.25 to 3.125 per block – or from 900 Bitcoins produced each day to 450 Bitcoins produced daily. Eventually, the number of Bitcoins will hit its maximum supply of 21 million coins – expected to be by the year 2140. There are roughly 19.6 million Bitcoins in existence today.

Now, Bitcoin has gone through three of these cycles so far. The first was in November 2012. The second was in July 2016. The third was in May 2020. And every time, Bitcoin’s price has rallied substantially.

As one can see in the chart above, the value of Bitcoin lifts off in a four-year predictable schedule. Each gain was realized within approximately 12-18 months from the halving trigger date.

Although nowhere near the gains after the halving occurs, there is also typically a considerable bump in price leading up to the halving. (Like we have seen this year, with Bitcoin breaking $73,000.)

Why does this predictable event result in these outsized gains? It is pretty much Economics 101: As supply decreases and demand remains constant (or increases), the only thing left to move is price.

The next halving is projected to take place around April 19-20, 2024. So, if the past is prologue, some of these gains have been driven by halving anticipation, but more is still to come.

Again, our investment team is not making a “call” on Bitcoin, but we do want you to know 1) What the halving is and 2) The historical impact of it on Bitcoin prices; because while history does not repeat itself, it often rhymes. At a minimum, our team wants our clients to be able to turn any questions on this topic into opportunities to impress their friends.

What the Fed Decision Means for Markets: Still All About Growth

The Fed decision was essentially “not as hawkish as feared” given the recent firm price data, and the practical impact of last week’s decision was to 1) Keep markets expecting a June rate hike and 2) Keep the “impending Fed rate cuts” part of the bullish mantra powering stocks higher intact. So, a not-as-hawkish-as-feared result combined with a still-intact bullish narrative pushed stocks to fresh highs in the wake of the Fed decision.

But if there was a “beneath the surface” take away from the Fed, it is that the major focus for investors right now needs to be on growth and specifically whether growth can hold up. There were some small hints that Powell and the Fed may be a bit more worried about growth than the market currently expects, but the bottom line is that the market is not getting more than three rate cuts in 2024 unless growth rolls over and at that point, it is too late anyway. That matters because it implies that rates are indeed going to be mostly higher for longer and higher rates will continue to act as a headwind on growth.

Put differently, the relief from high rates that investors keyed on during the Q4 rally is not coming. Yes, there will be two to three cuts barring a growth rollover, but we are still going to exit 2024 with fed funds over 4.5%.

Markets have tolerated that disappointment well so far in 2024 for two reasons. First, AI enthusiasm continues to rage and that is helping keep the bull market alive and well. Second (and this is more fundamentally important), it is because growth has held up. The market does not care if we get fewer rate hikes as long as growth is not showing any signs of cracking. But if those signs of cracking do start to appear, then the fact that there will only have been one rate cut by July will matter, a lot, because policy will be viewed as restrictive and the outlook for markets will change, potentially violently.

Bottom line: With Fed policy known and major relief on rates not coming in 2024, we must focus on growth and make sure we see, as early as possible, any evidence of a rollover because if that happens, it is a major problem for this market. And that is exactly what we will be doing for our clients.

For now, the bullish mantra of solid growth, falling inflation, impending Fed rate cuts and AI enthusiasm is alive and well and the S&P 500 has hit new highs. Until multiple points in the mantra are invalidated, the path of least resistance in this market remains higher and pullbacks should be viewed as entry points. While AI headlines have been strong, we expect the rally to continue to broaden.

Disclaimer: The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.