Robo-advisors are considered to be a popular and cost-effective solution for those seeking automated investment management. But what exactly is a robo-advisor, and how do they work? Today, I will explain digital investment platforms – from their features and benefits to their limitations and potential risks. What really is a robo-advisor and how does it work?

What is a Robo-Advisor?

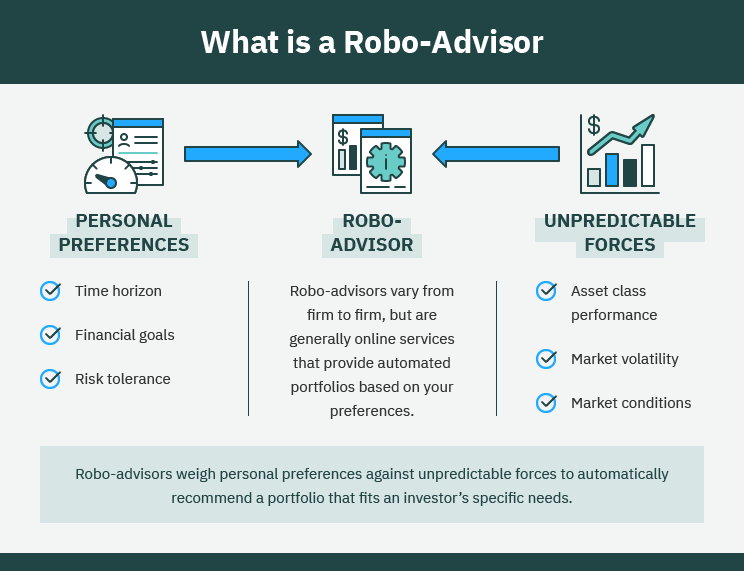

A robo-advisor is an online platform that uses algorithms and computer programs to provide automated investment advice and management services to clients. Robo-advisors typically use a set of questions to determine an investor's financial goals, risk tolerance, and investment time horizon, and then use this information to create a customized investment portfolio for the client. The portfolios are often diversified across asset classes, such as stocks, bonds, and cash, and are typically managed using a passive investment strategy, such as index fund investing.

Robo-advisors are often cheaper than traditional human financial advisors because they do not require the same level of human interaction and expertise. They also offer greater accessibility to investors with smaller account sizes, as some robo-advisors have low or no account as a minimum.

Did You Know?

Assets Under Management (AUM): As of 2023, global robo-advisory services are estimated to manage over $1.4 trillion in assets.

Projected Growth: The robo-advisory market is expected to grow to over $2.5 trillion in AUM by 2025.

User Base: More than 200 million people worldwide are projected to use robo-advisory services by 2025.

Market Penetration: In the U.S., robo-advisors manage about 0.5% of all investable assets.

Annual Growth Rate: The robo-advisory sector has seen an annual growth rate of approximately 15-20% over the past five years.

However, robo-advisors may not be suitable for all investors, especially those with more complex financial situations or those who prefer a more hands-on approach to managing their investments.

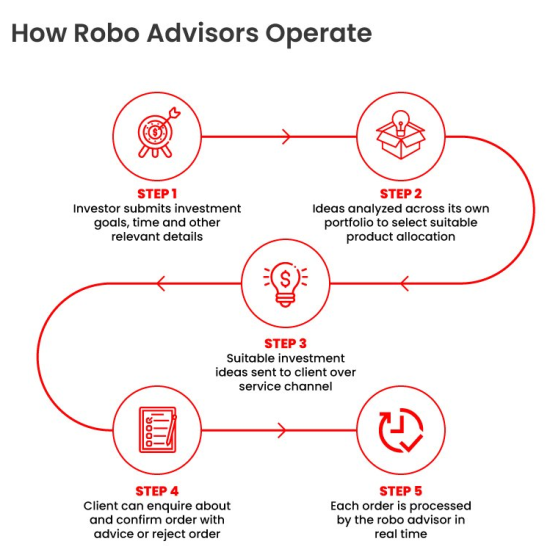

How Does a Robo-Advisor Work?

When you open an account with a robo-advisor, you'll first need to answer a few questions about your financial goals, risk tolerance, and time horizon. Based on your answers, the robo-advisor will create a customized investment portfolio for you made up of low-cost exchange-traded funds (ETFs).

Your portfolio will be rebalanced periodically to keep it on track with your original goals, and you'll be able to monitor your progress online or through a mobile app. Some robo-advisors also offer additional features like human financial planning advice, tax loss harvesting, and retirement planning tools.

The Benefits of Using a Robo-Advisor

There are several benefits to using a robo-advisor for investment management:

Low Cost: Robo-advisors typically charge lower fees than traditional financial advisors, making them an attractive option for investors who want to keep costs low.

Automated Portfolio Management: Robo-advisors use algorithms to create and manage portfolios of low-cost index funds or exchange-traded funds (ETFs) that align with an investor's goals and risk tolerance. This automated approach can help ensure that portfolios are well-diversified and optimized for performance.

Accessible: Robo-advisors are typically easy to use and accessible, with many platforms offering mobile apps and online portals that allow investors to manage their portfolios from anywhere.

Personalized Investment Advice: Many robo-advisors use sophisticated algorithms to create personalized investment plans for investors, taking into account factors such as risk tolerance, investment goals, and time horizon.

Tax Efficiency: Some robo-advisors offer tax-loss harvesting services, which can help investors minimize their tax liabilities by selling losing investments and replacing them with similar securities.

Transparency: Robo-advisors typically offer a high degree of transparency, providing investors with clear and easy-to-understand information about their portfolios, fees, and performance.

Passive Investing: Robo-advisors are often focused on passive investing, which means that they typically invest in low-cost index funds or ETFs. This approach can help investors achieve market-like returns over the long term while minimizing fees and transaction costs.

As you can see, the lower costs, automated portfolio management, personalized investment advice, tax efficiency, transparency, and a focus on passive investing can all make robo-advisors an attractive option for many investors to manage their assets.