Financial Market Insight | January 2024

HIGHLIGHTS

- Weekly Market Preview: Five Market Assumptions to Know as we Start 2024

- Weekly Economic Cheat Sheet: Jobs Report in Focus

- Special Reports and Editorial:

- Two Important Differences in 2024

- Thoughts On 2024

STOCKS

STOCKS

| SOURCE: Factset and Vann Equity Management Research Team |

“Stocks were little changed last week in very quiet trade as investors wanted a quiet end to a very strong 2023 as the S&P 500 rose more than 24% on the year.”

- What’s Outperforming: Growth factors, tech, consumer discretionary and communication services, the worst performers in 2022, have outperformed YTD. However, higher yields remain a headwind and as such we do not think this outperformance will last over the longer term.

- What’s Underperforming: Defensive sectors and value have underperformed YTD but are still massively outperforming since the bear market started in 2022, and since our primary concern in 2023 was economic growth, we think underperformance will be temporary.

Five Market Assumptions to Know as We Start 2024

The S&P 500 is starting 2024 trading at a very lofty 19.5X valuation and while we are not going to say that valuation is unjustified, we will say that valuation makes several key, positive assumptions about critical market influences in the coming year. How reality matches up with those assumptions will determine whether stocks extend the rally (and the S&P 500 hits new highs and makes a run at 5,000) or give back much of the Q4 Santa Claus rally.

As such, we want to start 2024 clearly defining the five most important assumptions investors are making right now because it is how these events occur vs. these assumptions, and not absolute values, that will determine if stocks and other assets rise or fall in Q1 and 2024.

Assumption 1: Fed cuts rate six times for 150 basis points of easing and a year-end fed funds rate below 4.0%.

The main factor behind the S&P 500’s big Q4 rally was the assumption that the Fed was done with rate hikes and would be cutting rates early and aggressively in 2024. How do we know this is a market assumption? Fed fund futures. According to Fed fund futures, there is a 70%-ish probability the Fed fund rates end 2024 between 3.50% – 4.00%.

Assumption 2: No Economic Slowdown.

Markets have not just priced in a soft landing, they have priced in effectively no economic slowdown as investors expect growth to remain resilient and inflation to decline, the oft-mentioned “Immaculate Disinflation,” a concept that is possible, but to our investment team’s knowledge has never actually happened. How do we know this is a market assumption? The market multiple. The S&P 500 is trading at 19.5X the $245 expected S&P 500 earnings expectation. A 19.5X multiple is one that assumes zero economic slowdowns (if markets were expecting a mild slowdown, a 17X-18X multiple would be more appropriate).

Assumption 3: Solid Earnings Growth.

Markets are expecting above-average earnings growth for the S&P 500 to help power further gains in stocks. How do we know this is a market assumption? The consensus expectations for 2024 S&P 500 earnings per share are mostly between $245-$250. That is nearly 10% higher than the currently expected $225 per share earnings for last year (2023), which points to very strong annual corporate earnings growth.

Assumption 4: No Additional Geopolitical Turmoil.

Despite the ongoing Russia/Ukraine war, Israel/Hamas conflict and escalating tensions between the U.S. and Iranian-backed militias throughout the Middle East, the market’s assuming no material increase in geopolitical turmoil. How do we know this is a market assumption? Oil prices. If markets were nervous about geopolitics, Brent Crude prices would be solidly higher than the current $77/bbl. Oil prices in the high $80s to low $90s reflect elevated geopolitical concern while prices above $100/bbl reflect real worry.

Assumption 5: No Domestic Political Chaos.

This is an election year in the U.S. The Republican front runner, Donald Trump, is facing a long list of various civil and criminal charges along with challenges to whether his name will be on the ballot in certain states. Meanwhile, there has been no long-term compromise on funding the government, so shutdown scares remain a real possibility; and that is before we get into the heart of election season later this year. How do we know this is a market assumption? Treasury yields. A 3.80%-ish yield on the 10-year Treasury does not reflect much domestic political angst. If markets become nervous about the U.S. political situation and/or fiscal situation in the U.S., the 10-year yield would be sharply higher than it is now (well above 4%, like we saw in the late summer/early fall).

Bottom line: These market assumptions are not necessarily wrong. Events could unfold the way the market currently expects. However, these assumptions are aggressively optimistic, and it is how events unfold versus these expectations and not on an absolute scale that will determine how stocks and bonds trade to start the year.

Economic Data (What You Need to Know in Plain English)

Important Economic Data

The year starts off with a proverbial “bang” from an economic standpoint as we get the three most important economic reports of each month over the next four days. Now that the Fed has dovishly pivoted, “bad” data will not remain “good” for stocks very long, so expect the markets to begin to react negatively to soft reports here. The reason is clear: Now that the Fed has pivoted, bad economic data just means an increased chance of an economic slowdown, something that is not priced into markets with the S&P 500 trading at a 19X multiple.

The key report this week is Friday’s jobs report, which should be a solid, yet unspectacular, number of job adds with a slight drift higher in the unemployment report. Put simply, markets continue to need Goldilocks jobs data to support stock prices, but the margin for error of the report is much smaller now that the Fed has dovishly pivoted.

The next most important economic reports this week come on Wednesday and Friday via the ISM Manufacturing and Services PMIs. The ISM Manufacturing PMI remains below 50 and is expected to stay there while the ISM Services PMI remains slightly above 50. The reason these two reports are important is that if both reports drop below 50 for a few months, that would be a very accurate historical indicator of a looming economic slowdown. The point is that markets will want to see improvement in the ISM Manufacturing PMI and stability (so staying comfortably above 50) in the Services PMI.

The final important economic reports of the week are labor market-related via today’s JOLTS (Job Openings and Labor Turnover Survey) and Thursday’s weekly jobless claims. As mentioned, the labor market broadly remains strong but not too hot and markets will want to see data that reinforces strong employment, but not so strong it increases wages and a bounce in inflation.

Bottom line: Now that the Fed has dovishly pivoted, investors will want to see stability in the economic data above all else in Q1, because if economic data starts to roll over from here, more expected Fed rate cuts will not help (they will be too late) and with the S&P 500 trading above 19X next year’s earnings, there simply is zero economic slowdowns priced into stocks (although Treasuries would rally in the face of soft economic data).

Economic Data (What You Need to Know in Plain English)

Economic Data (What You Need to Know in Plain English)

Important Economic Data

The year starts off with a proverbial “bang” from an economic standpoint as we get the three most important economic reports of each month over the next four days. Now that the Fed has dovishly pivoted, “bad” data will not remain “good” for stocks very long, so expect the markets to begin to react negatively to soft reports here. The reason is clear: Now that the Fed has pivoted, bad economic data just means an increased chance of an economic slowdown, something that is not priced into markets with the S&P 500 trading at a 19X multiple.

The key report this week is Friday’s jobs report, which should be a solid, yet unspectacular, number of job adds with a slight drift higher in the unemployment report. Put simply, markets continue to need Goldilocks jobs data to support stock prices, but the margin for error of the report is much smaller now that the Fed has dovishly pivoted.

The next most important economic reports this week come on Wednesday and Friday via the ISM Manufacturing and Services PMIs. The ISM Manufacturing PMI remains below 50 and is expected to stay there while the ISM Services PMI remains slightly above 50. The reason these two reports are important is that if both reports drop below 50 for a few months, that would be a very accurate historical indicator of a looming economic slowdown. The point is that markets will want to see improvement in the ISM Manufacturing PMI and stability (so staying comfortably above 50) in the Services PMI.

The final important economic reports of the week are labor market-related via today’s JOLTS (Job Openings and Labor Turnover Survey) and Thursday’s weekly jobless claims. As mentioned, the labor market broadly remains strong but not too hot and markets will want to see data that reinforces strong employment, but not so strong it increases wages and a bounce in inflation.

Bottom line: Now that the Fed has dovishly pivoted, investors will want to see stability in the economic data above all else in Q1, because if economic data starts to roll over from here, more expected Fed rate cuts will not help (they will be too late) and with the S&P 500 trading above 19X next year’s earnings, there simply is zero economic slowdowns priced into stocks (although Treasuries would rally in the face of soft economic data).

COMMODITIES, CURRENCIES & BONDS

COMMODITIES, CURRENCIES & BONDS

“Commodities decline slightly following a reduction in geopolitical tension and despite a continued decline in U.S. dollar.

| SOURCE: Factset and Vann Equity Management Research Team |

”Commodities declined broadly in the last week of 2023, thanks mostly to declines in oil as geopolitical tensions eased slightly.

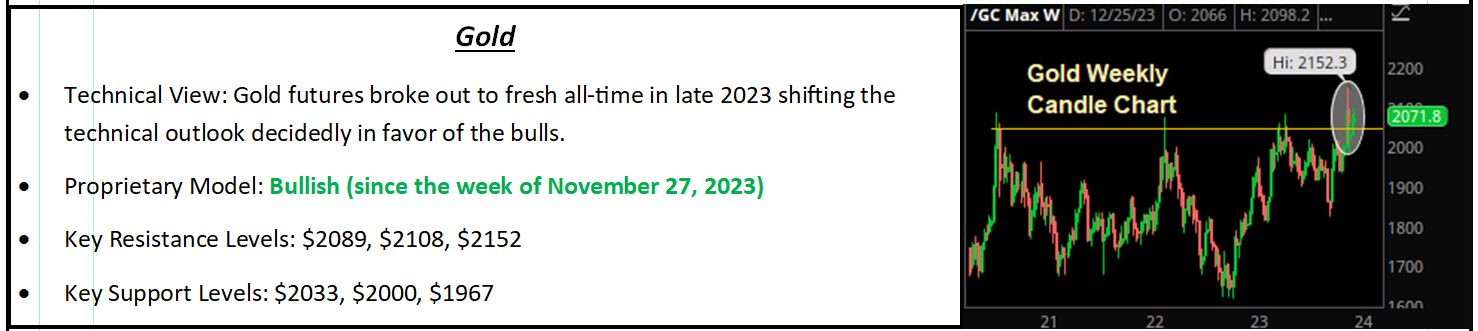

Gold changed little during the week as there was little data or Fed speak to trade-off. Midweek dollar declines helped boost gold, but the impact was modest, although gold remains within striking distance of the new all-time highs hit in early December. Looking forward, we can expect gold to continue to trade inversely off the U.S. dollar and as long the dollar remains broadly under pressure the outlook for gold will remain positive.

OIL MARKET UPDATE

OIL MARKET UPDATE

Looking forward, geopolitics will remain an important influence on oil but, barring a major escalation in the Russia/Ukraine war or Israel/Hamas conflict, the larger supply/demand picture will drive oil prices, and as we start the year there remain real concerns 1) If global demand can stay resilient (there are hints the global economic is slowing) and 2) If OPEC+ can remain disciplined on supply (their actions late last year underwhelmed traders) and as such the outlook for oil prices remains mixed over the longer term.

SPECIAL REPORTS AND EDITORIAL

SPECIAL REPORTS AND EDITORIAL

Two Important Differences in 2024

Each year in markets is different (it is one of the reasons this is such an interesting business) and there are usually many changes from one year to another. However, there are two important changes that will occur in 2024 that we want to point out because these changes mean that events that were tailwinds for stocks in 2023 (falling yields and earnings results) will become neutral to potentially negative in 2024.

Change 1: Falling Yields Will not be Positive for Stocks

There were two overarching reasons for the rally in 2023: The first was AI enthusiasm powering the “Magnificent Seven” stocks higher and pulling the S&P 500 with it. The second was the expectation of a dovish Fed pivot that essentially saved the 2023 rally in late October.

Falling interest rates were a clear positive in 2023 because they 1) Eased valuation headwinds and 2) Signaled that Fed hikes were ending, which reduced recession changes. However, as we start 2024, the dovish Fed pivot is fully priced into stocks with the S&P 500 just under 4,800 and the market has priced in six Fed rate cuts and year-end 2024 fed funds below 4.00%.

So, the dovish pivot and expected easing policy is already priced into stocks and Treasuries. If we see the 10-year Treasury yield continue to fall to the low 3% or sub 3% range, that is not going to be a major tailwind for stocks because that will not be forecasting a dovish Fed, it will be forecasting slowing growth. Those falling yields will then become a harbinger of a potential economic slowdown and not the welcomed signal of a Fed that is finally turning dovish.

Change 2: Earnings Results Will not Have Low Expectations to Excuse Poor Performance

S&P 500 earnings were not particularly great in 2023 but they were much better than some of the awful expectations that were prevalent when the year started.

To put some numbers on it, many analysts penciled in 2023 S&P 500 earnings between $220 and $225, but there was a definite minority that had estimates much lower, anywhere from $185 to $215, as these analysts expected the recession that never appeared.

Now, as we start 2024, it is the total opposite. Consensus S&P 500 earnings growth is nearly 10% year over year, well above the longer-term averages of around 5%-ish annual growth. Keep in mind, at 4,800 the S&P 500 is trading over 19.5X that $245 earnings estimate, which means there is little room for disappointment from a valuation perspective.

So, “ok” earnings will not be good enough and we got a preview of that in the Q3 numbers (which were not great) and especially in December as results were generally poor. That does not mean the upcoming Q4 earnings season (which begins in mid-January) will not be positive, but for it to be positive it will have to be because of actual good results, not “better-than-feared” results that were good enough in 2023.

Bottom line: The markets will need something “new” to power stocks higher in 2024 because the dovish pivot (which powered stocks higher since October) is fully accounted for while low expectations for earnings and economic growth no longer exist. That does not mean we will not get new, positive influences on stocks, but it will have to come from something new in 2024 because the “low-hanging fruit” of dovish pivot and not-as-bad-as-feared earnings have already been picked to fuel the Santa rally.

Thoughts On 2024

As we look towards 2024, we cannot help but feel as though we are all in a proverbial canoe; and the investing public is violently running to one side of the canoe and then the other, causing it to nearly tip each time. Here is what we mean.

Think back to December 2021. The S&P 500 had just hit an all-time high. The impact of the pandemic was still being felt but tech companies were surging and leading the market higher. The investing public was convinced we were in a new “hybrid” world that was here to stay, fueled by stimulus and forced savings, growth was strong, inflation was rising, and markets admitted that the Fed needed to hike rates in 2022 but did not think it would be that bad. Put simply, market sentiment was resoundingly bullish and while investors admitted there were some issues, they were minimized and the outlook was very, very positive.

Of course, that optimism was unfounded. The Fed was much more aggressive on rate hikes, inflation exploded, growth slowed, and the S&P 500 dropped 19.4%. Put simply, consensus was universally bullish, and consensus was wrong.

Now think back to December 2022. Investors were despondent. The S&P 500 was ending the worst year in over a decade, the Fed was massively hiking interest rates, inflation was not breaking, recession fears were surging, and investors were convinced we were facing either 1) Stagflation or 2) An imminent recession.

Of course, that pessimism was unfounded as growth remained resilient, inflation was broken and the Fed dovishly pivoted. Put simply, the consensus was universally bearish, and the consensus was wrong.

Now, in December 2023, the consensus was absolutely bullish. The soft landing was all but assured. The Fed will cut six times in 2024 but not because of slowing growth and instead because inflation is about to go into some sort of freefall. Despite numerous geopolitical hot spots, none of them will get materially worse, U.S. politics will not be a problem and despite a potentially slowing economy and margin compression, companies in the S&P 500 will grow earnings by nearly 10% this year. The 5,000 mark on the S&P 500 is not a matter of “if,” it is a matter of “when.”

That all may come true and that might be exactly how it works out, but we have been in this industry long enough to know that when everyone seems to be on one side of the proverbial canoe, it is time to get nervous and move to the middle.

In December 2021, we cautioned against this universally bullish outlook as too complacent. Last year, we cautioned against the very bearish outlook saying under the surface, positives were in place.

Those were not predictions. Rather, they were observations stemming from 20+ years of “new year’s” in the markets. The reality of a market in any given year hardly ever matches the consensus and it almost never matches the consensus when it is this sure of the outcome.

We hope the consensus is right. We hope that in the year we are writing to you and the S&P 500 is above 5,000 and that it has been a great year for your businesses. But this universally bullish expectation makes us think everyone is on one side of the canoe when in reality, we need to be in the middle because things can go wrong.

We can still have a growth slowdown and a recession. It is not impossible. Earnings growth can falter as demand slows and margins compress. Geopolitics can provide real, negative surprises. Inflation can bounce back. Domestic politics can present a surprise (it is an election year). None of these events would be shocks, although thankfully, they are not the most likely case.

Bottom line: We view part of our job as making sure you have someone giving you agenda-free analysis that pulls you back to the middle of the proverbial canoe, and as we start 2024 that is what you can expect our Investment team to continue to do.

Disclaimer: The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.